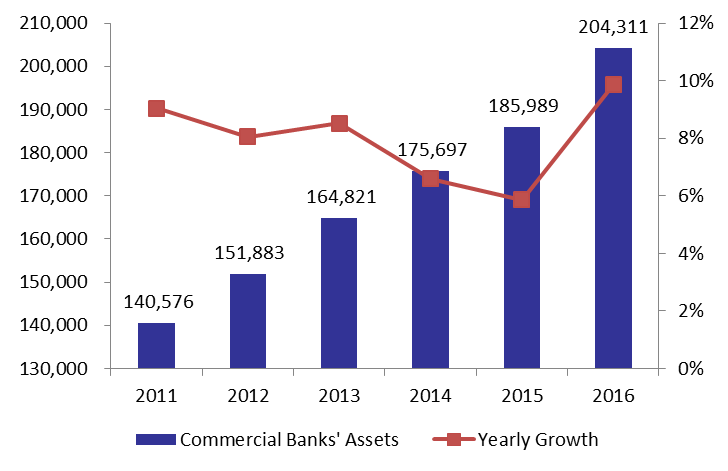

According to the Central Bank of Lebanon, the assets of commercial banks grew by a yearly 9.85% to $204.31B in 2016.

Claims on the resident private sector increased by a yearly 6.23% to $51.04B and claims on the non-resident private sector marginally dropped by a yearly 0.65% to $6.14B in 2016.

However, both claims on public sector and foreign assets observed respective drops of 8.14% and 2.92% by December 2016 to $34.72B and $23.1B. The drop in foreign assets can be mainly attributed to the decline in claims on non-resident financial sector that fell 2.74% y-o-y to $11.24B, while the decrease in claims on public sector is primarily justified by the lower subscription to T-bills in LBP and Eurobonds that dropped by 4.32% and 12.82% since year-start to $19.20B and $15.38B, repectively.

Within the swap operation, the banks discounted their T-bills at the Central Bank at a premium and also sold Eurobonds in a bid to provide the Central Bank with additional foreign currency.

On the liabilities side, resident private sector deposits grew by 7.36% y-o-y to $128.53B while non-resident private sector deposits grew by 6.60% to $33.96B in 2016. The dollarization ratio of private sector deposits rose from 64.88% in 2015 to 65.82% in 2016.

Commercial Banks’ Assets, In $M

Source: Central Bank of Lebanon