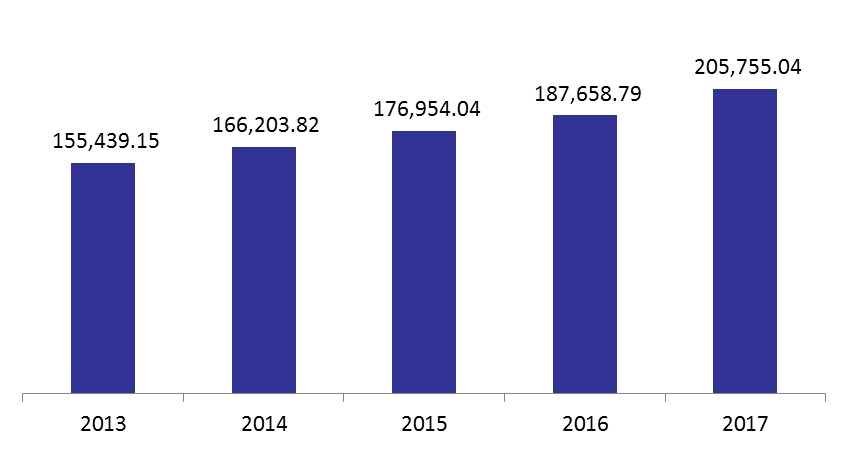

According to the consolidated balance sheet of Lebanon’s commercial banks, total assets continued to show progress in March 2017 as they grew by 9.64% y-o-y to $205.8B mainly due to BDL’s swap operation conducted starting June 2016. Nonetheless, we conduct a year-to-date (YTD) analysis of the balance sheet for a more reflective analysis of the first three months of the year.

On a YTD basis, Foreign Assets recovered from low post-Swap balances, as they recorded a growth of 7.26% from December 2016, progressing to $24.78B. This increase was driven by the 16.24% YTD growth in Claims on the non-resident financial sector to $13.07B, as commercial banks sold to foreign entities, a portion of their subscription to the government’s March 23rd Eurobond- issue and placed the proceeds abroad in order to replenish their foreign holdings.

It is worthy to mention that Claims on the non-resident private sector recorded a decline of 2.54% YTD to stand at $5.98B.

Claims on the resident private sector inched up by 0.31% YTD to $51.2B in March 2017. The increase is attributed to the 3.33% YTD rise in claims in Lebanese Pounds to $16.18B, while claims in foreign currency slipped by 1.03% from December 2016 to $35.02B over the same period. As such, the dollarization rate of private sector loans slipped from 72.61% in December 2016 to 71.70% in March 2017 due to BDL’s subsidized loans in Lebanese pounds, such as the housing incentive. Claims on the public sector also rose by 8.71% YTD, to stand at $37.75B in the same period.

However, Total Reserves registered a 3.79% down tick to $86.35B, due to Deposits with the Central bank slipping from $89.3B in December 2016 to $85.86B. This decline is partly explained by the banks discounting their holdings of BDL certificates of deposits denominated in USD in order to participate in the Eurobonds issue of March 23rd 2017.

As for the commercial banks’ liabilities, Resident Private sector deposits ticked up by 1.25% YTD, to stand at $130.14B in March this year, driven by a 1.82% YTD rise in Deposits in foreign currencies to $78.93B, while local currency (LBP) deposits recorded an incremental 0.39% improvement to $51.21B. Similarly, Non-resident private sector deposits also increased by 0.73% YTD to $34.21B, but on the back of a 1.12% YTD increase in foreign currency deposits $29.76B and a 1.77% YTD decline in LBP-deposits to $4.45B. As such, the dollarization rate of total private sector deposits rose from 65.82% in December 2016 to 66.13% by the end of March 2017. As for public sector deposits, they ticked up by 7.64% from December 2016 to stand at $4.25B in March 2017.

Total Commercial Banks’ Assets by March (in $M)

Source: Banque du Liban