The resignation of PM Saad Hariri on November 4 shook the Lebanese political scene. As such, depositors either transferred their savings outside the country or exchanged their LBP deposits to USD, amid the uncertainty of the political situation.

In fact, the balance sheet of Lebanon’s commercial banks revealed that private sector deposits dropped by $2.59B. In details, resident private deposits decreased by a monthly 1.09% ($1.46B) to $132.44B by November 2017, as a result of a 5.66% ($2.90B) fall in LBP deposits and 1.74% ($1.44) m-o-m rise in FC deposits. Similarly, non-resident private sector deposits fell by 3.19% ($1.13B) to $34.37B. Consequently, the dollarization ratio for private sector deposits slightly rose from 65.82% in December 2016, and 67.27% in October 2017 to 68.51% in November 2017.

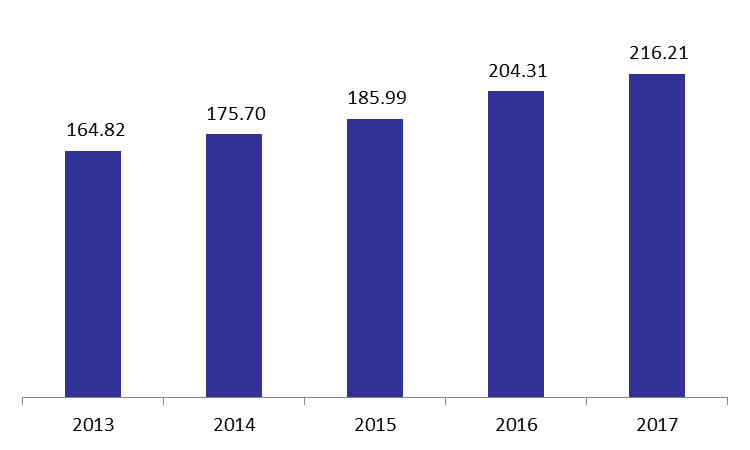

As for the banks’ total assets, they merely rose by a monthly 0.19% to reach $216.21B by November 2017. The rise can be attributed to the 0.38% rise in deposits with the central bank that reached $101.07B. Also, claims on the resident private sector witnessed a rise of 0.43% to reach $53.43B by November 2017 compared to $53.21B by October 2017.

However, driven by political instability, claims on the public sector witnessed a monthly downtick of 1.47% to reach $32.86B by November 2017. In fact, their portfolio of Eurobonds declined by a monthly 2.51% to $14.3B as a result of selling them in order to replenish their liquidity for USD. Moreover, lower subscriptions to treasury bills in Lebanese Pounds was registered during the month, as they fell by 0.67% to $18.41B by November 2017, despite 5Y yields reaching 8%.

Total Assets of Commercial Banks by November of each Year ($B)

Source: Central Bank of Lebanon