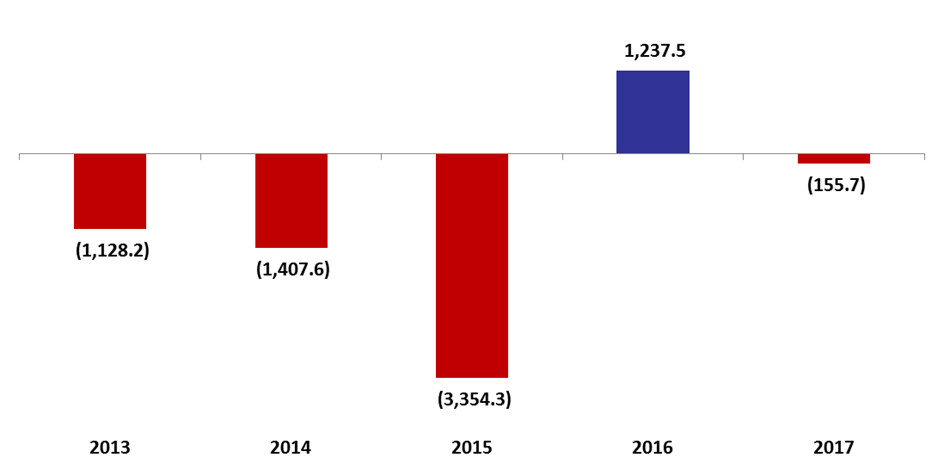

Lebanon’s Balance of Payments (BoP) ended 2017 with a $155.7 million (M) deficit compared to 2016’s $1.2B surplus explained by Lebanon’s central bank Swap operation conducted June 2016.

In 2017, three key events impacted the BOP throughout the year, and these include: the March 2017 issuance of $3B in Eurobonds, the November political crisis, and the $1.7B Eurobonds swap between BDL and the MoF. As a result, the BOP recorded a $1.12B deficit in the first six months of the year, which outweighed the $959.9M surplus recorded in H2 2017.

In details, BDL’s swap operation in H2 2016 sent the BOP into its first surplus in three years, at $508.5M by Feb. 2017. The surplus was maintained with the BOP recording $46.3M in surplus as commercial banks’ NFA surged while BDL’s contracted, on the back of Lebanon’s successful sale of $3.0B worth sovereign Eurobonds in March 2017.

The year also entailed the Lebanese Prime Minister Resignation Crisis which boosted demand on the dollar and pushed depositors to transfer part of their savings out of the country. As such, by December 2017, BDL’s Net Foreign Assets (NFAs) added $1.61B, while the commercial banks’ NFAs retreated by $1.77B owing it to the banks’ selling Eurobonds to replenish their liquidity for the USD during the political uncertainty.

It is worthy to note that the largest deficits recorded in Lebanon’s BOP this year were in June and October 2017, whereby the BOP deficits stood at $758M and 887.8M, respectively.

In the month of December alone, the BOP recorded a surplus of $853.8M compared to a surplus of $909.8M in December 2016. In details, commercial banks’ NFAs rose by $748M and the Central Bank’s NFAs grew by $105.8M in 2017.

Lebanon’s Balance of Payments (in millions of $)

Source: Banque du Liban