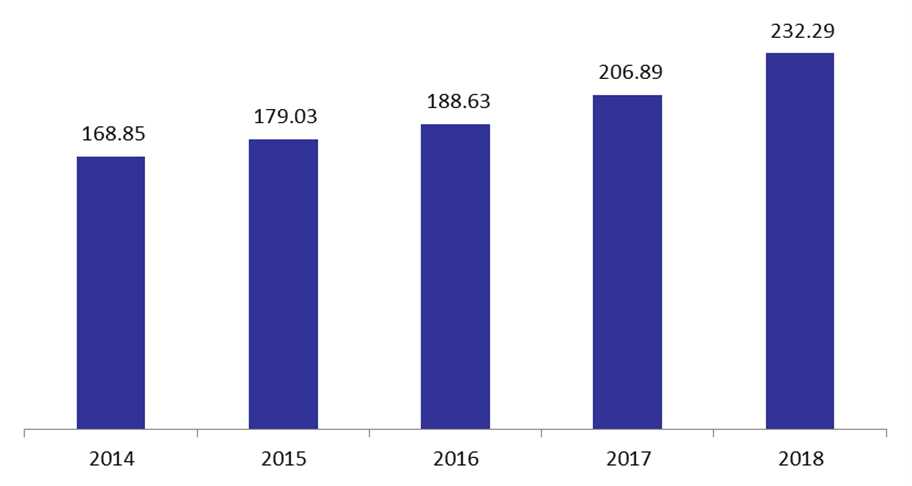

According to Lebanon’s consolidated commercial banks’ balance sheet, total assets grew by 5.65% year-to-date (y-t-d) and by 12.28% year-on-year (y-o-y), to stand at $232.29B by May 2018.

In details, Resident customers’ deposits (which grasp 57.97% of total liabilities) grew by an incremental 1.06% y-t-d to $134.65B by May 2018, with deposits in LBP adding 2.27% y-t-d to $49.53B, v/s those in foreign currencies adding 0.37% y-t-d. As for the Non-resident customers’ deposits (15.74% of total liabilities), they increased by 4.01% y-t-d and totaled $36.57B over the same period on the back of deposits in LBP recording a growth of 8.19% y-t-d to $4.6B, v/s a 3.44% uptick in deposits in foreign currencies. As such, the dollarization ratio for private sector deposits slightly retreated from 68.72% in December 2017 to 68.35% in May 2018.

However, total resident and non-resident customers’ deposits stood at $171.22B in the first 5 months of the year, rising by 1.68% y-t-d equivalent to an annualized 4%, which is relatively low. In fact, the stalling growth came on the back of the central bank’s reduced subsidies coupled with higher interest rates offered, which are crowding out the domestic private sector as banks prefer BDL’s more attractive products.

In their turn, Non-resident financial sector liabilities also grew by 13.51% y-t-d and 30.57% year-on-year, to $8.49B by May 2018 which further explains banks’ borrowings being partly used to subscribe to BDL’s offerings.

On the assets side, Reserves (constituting 49.67% of total assets) recorded a 3.85% y-t-d uptick to settle at $115.38B by May 2018. The increase in reserves came on the back of an 11.02% y-t-d climb in deposits with the central bank (BDL).

Meanwhile, Claims on resident customers (22.62% of total assets) retreated by 1.69% y-t-d which is equivalent to an annualized 4%, to stand at $52.54B by May 2018. This decline in credit is justified by the crowding out of the private sector, explained in the liabilities section of the banks’ balance sheet.

As for Claims on the government, they grew by 6.53% since the beginning of the year to stand at $35.53B and the rise is largely attributed to the Eurobonds new issuance worth $3B that took place in May 2018. In fact, the subscription to T-bills in LBP decreased by 3.08% y-t-d to $17.07B while subscriptions to Eurobonds climbed by 17.17% to $16.61B by May 2018.

Commercial Banks’ Total assets by May (in $B)

Source: BDL