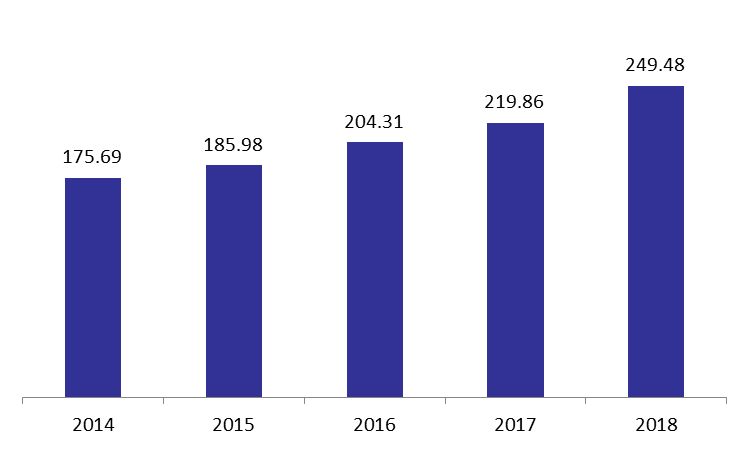

According to Lebanon’s commercial banks’ balance sheet, total assets witnessed an increase of 13.48% year-to-date (y-t-d) to stand at $249.48B by December 2018.

In details, deposits with BDL, constituting 52.42% of the total assets, rose by 25.83% to $130.77B.This was mainly due to the financial engineering implemented by BDL since 2017 offering commercial banks appealing schemes to attract foreign currencies.

Meanwhile, claims on resident customers (20.76% of total assets) declined by 3.09% in 2018 to stand at $51.80B by December 2018. In details, both, the claims on resident customers in Lebanese pound and in foreign currencies observed respective drops of 6.09% and 1.64% during the same period to stand at $16.33B and $35.47B. In Fact, the average interest on Loans in LBP and USD rose by a yearly 27.19% and 17.08% to reach 10.15% and 8.57% respectively in November 2018, defacto crowding out the private sector from commercial and individual credit markets, especially as BDL subsidy to housing loans stopped in March 2018.

Worth mentioning, subscription to Eurobonds increased by a yearly 13.12% to stand at $16.04B in 2018. Lebanon’s Central Bank sold $3.022 billion of sovereign Eurobonds from its portfolio to commercial banks and financial institutions, following the swap that it conducted with the ministry of finance in May as part of its financial engineering. On contrary, subscription to T-bills decreased by a yearly 1.35% to $ 17,38B.

On the liabilities side, Resident customers’ deposits (54.29% of total liabilities) witnessed an increase of 1.66% y-t-d to reach $135.45B by December 2018. In details, the 4.92% increase in foreign currencies deposits to $88,98B offset the 4.03% decrease in deposits in LBP to $46.48B in 2018 that was mainly driven by investors’ fears that the current economic and political situation might affect the Lebanese pound and its stability.

Non-resident customer’s deposits (27.85%of the total liabilities) witnessed an increase of 7.31% since the beginning of the year to $37,73B. The increase took place in both deposits foreign currencies and LBP recording 8.19%and 0.95% to $33.41B and $4.31B respectively. This was the result of intense competition between banks to attract deposits. In details, average interest rates on deposits in LBP and USD jumped over the past year by 35.54% and 28.95% to reach 7.97% and 4.9% in November 2018 respectively.

As such, the dollarization ratio of private sector deposits rose from 68.72% in December 2017 to 70.62% in December 2018.

Commercial Banks’ Total assets by December (in $Billions)

Source: BDL