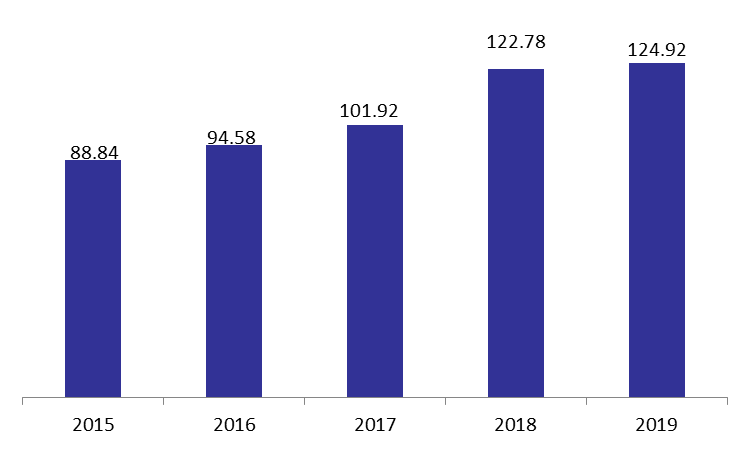

The Central Bank’s (BDL’s) balance sheet posted an 11.15% year-to-date (y-t-d) decline in its total assets, which reached $124.92B in March 2019. The Central Bank of Lebanon carried out a netting operation between its “Loans to the local financial sector” and “Financial Sector Deposits”. According to BDL, this offsetting of loans with their corresponding deposits is in accordance with IFRS 7.

BDL has been conducting financial engineering schemes with Lebanese commercial banks according to which BDL provides loans with low interest rates at 2% in Lebanese pound to the banks and agreed with banks to deposit 125% of the amounts the former granted them at a 10.5% interest to be blocked over the next 10 years, in exchange for foreign currency deposits from the banks.

BDL’s foreign assets (grasping 30.87% of total assets), fell by 2.79%, to stand at $38.56B in the first quarter of 2019.

Moreover, Securities portfolio (25.53% of total assets) added 3.43% to reach $31.89B over the same period.

Worth mentioning that Loans to the local financial sector (12.20% of total) dropped by 54.65% y-t-d, to $15.24B over the same period. However, the Central Banks’ Gold reserves (constituting 9.53% of total assets) added a yearly 1.16%, to $11.91B by Q1 2019.

On the liabilities side, financial sector deposits (83.11% of total liabilities) fell by 13.32% y-t-d to $103.83B. Also, Public sector deposits (3.50% of the total) decreased by 12.91% to $4.38B by March 2019.

BDL’s Total Assets in March (in $B)

Source : BDL