According to the central bank’s (BDL) balance sheet, total assets dropped by 10.88% year-to-date (YTD), to reach $125.30B in April 2019. In fact, the changes in most of the accounts can be related to BDL’s netting operation between its “Loans to the local financial sector” and “Financial Sector Deposits”. According to BDL, this offsetting of loans with their corresponding deposits is in accordance with IFRS 7

In details, BDL’s Foreign assets (constituting 30.30% of total assets) declined by 4.27% since December 2018 to reach $37.97B, while the “Securities portfolio” (constituting 25.51% of total assets) recorded a 3.65% YTD uptick to settle at $31.96B over the same period. In their turn, “Loans to the local financial sector” (12.14% of total assets) witnessed a significant decrease from $33.61B in December 2018 to $15.21B in April 2019. As for “Gold assets” (9.46% of total assets), they recorded an uptick of 0.69% YTD, to stand at $11.85B.

On the liabilities side, “Financial Sector Deposits” (83.38% of BDL’s total liabilities) decreased by 12.78% YTD to reach $104.47B in April 2019. As for “Public sector deposits”, (2.94% of total liabilities), they declined by 26.71% YTD to $3.68B in April 2019.

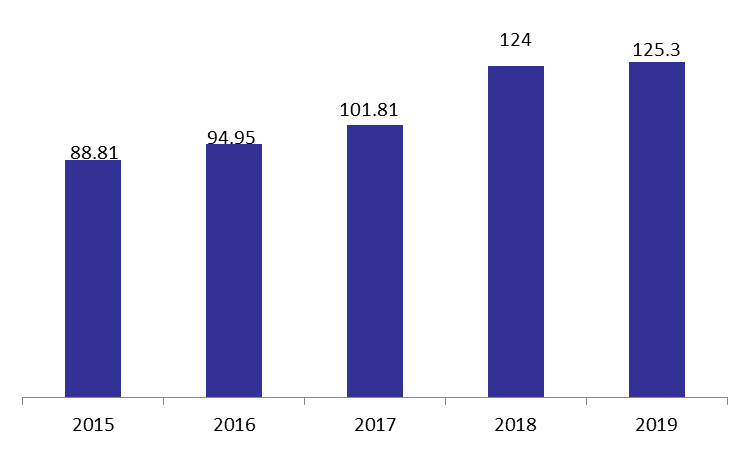

Yearly levels of BDL’s Total Assets in April ($B)

Source: BDL