According to E&Y’s Middle East Hotel Benchmark Survey, Beirut recorded improvements on all the measured key performance indicators (KPIs) in the first quarter of the year. This can be mainly attributed to the formation of government (end-Jan. 2019) that eased fears of political instability in the country, while talks on new infrastructure projects to nurture the tourism sector also came to light in Q1 2019 in the context of unlocking funds pledged by the Cedre conference.

In details, Beirut’s hotel occupancy rate rose from 57.9% in Q1 2018 to 69.8% in Q1 2019. In turn, annual upticks were registered in Beirut’s average room rate and rooms yield, which climbed from $173 and $100 in Q1 2018 to $189 and $132 in Q1 2019, respectively. In fact, the upticks across the board in Beirut came on the back of a 1.31% annual growth in airport passengers to 1.75M travelers in Q1 2019, in addition to annual rises recorded in the number of Arab tourists. In details, tourists from the Arab world added a yearly 11.19% to hit 84,519 travelers by Feb. 2019, but it is worthy to also note the surge in the number of tourists from Saudi Arabia. These last rose from 6,009 visitors by Feb. 2018 to 10,041 by Feb. 2019 with the KSA lifting the travel ban.

Over the same period, Cairo was the only other country that witnessed upticks across the board. In fact, Cairo’s hotel occupancy rate rose by 4.5 percentage points (p.p) yearly, to end the first quarter of 2019 at 78.2%. It followed that Cairo’s average room rate added 4.1% to $107 while the rooms yield grew by 10.5% to $84 in Q1 2019. In details, Cairo held a series of events over the period, including the UNWTO and Egypt Petroleum Show among other plans to improve exposure and archeological discoveries by 2020. All these developments boosted Cairo’s image as the “city of business and leisure”.

As for Abu Dhabi, its occupancy rate slid by an annual 0.2 p.p to stand at 84.9% in Q1 2019. Nonetheless, the drop was only marginal and the city maintained last year’s occupancy rates while its average room rate and rooms yield rose from $105 and $90 to $122 and $103, respectively by March 2019. The rise in Abu Dhabi’s 4-and 5-star hotel revenues is mainly attributed to the grand events the city witnessed over the period, which entailed the historical papal visit, the Special Olympics World Games, AFC Asian Cup Football Tournament and others.

Meanwhile, Kuwait witnessed a drop across all its KPIs. The city’s hotel occupancy rate decreased by 5.6 p.p. to 60.8% in Q1 2019 owing to “softer economic conditions” over the period and fewer events held to attract tourists. As such, average room rate and rooms yield declined by a yearly 9.8% and 17.4%, to end the first quarter of the year at $182 and $111, respectively.

In the KSA, performance was weak across the board in Makkah and Madinah prior to the month of Ramadan, knowing both are holy cities and main destinations for hajj. While the hotel occupancy rate in Makkah rose by 9.2 pp to 72.9% in Q1 2019, average room rate and rooms yield slipped from $113 and $72 to $96 and $70. Meanwhile, occupancy rates in Madinah retreated by 10.7 pp to 63.5%. Accordingly, the average room rate remained at $119, while the rooms yield fell by an annual 13.9% to $76, respectively, in Q1 2019. However, performance of luxury hotels in both cities is expected to improve in the coming months of Ramadan.

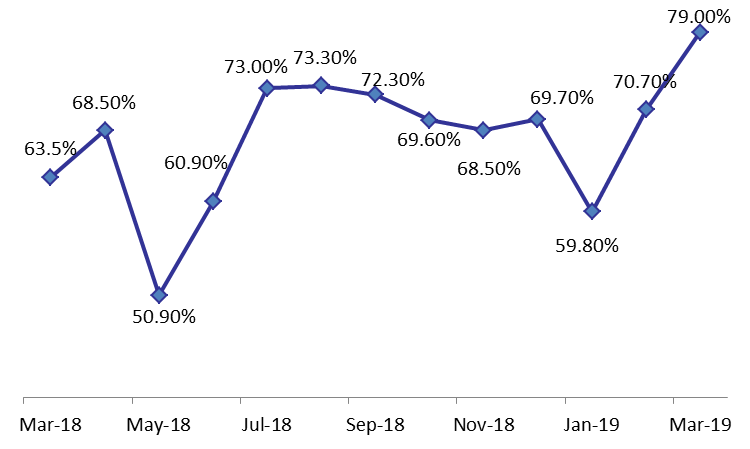

Monthly Occupancy Rates in Beirut’s 4- and 5-star Hotels

Source: E&Y Middle East Hotel Benchmark Survey