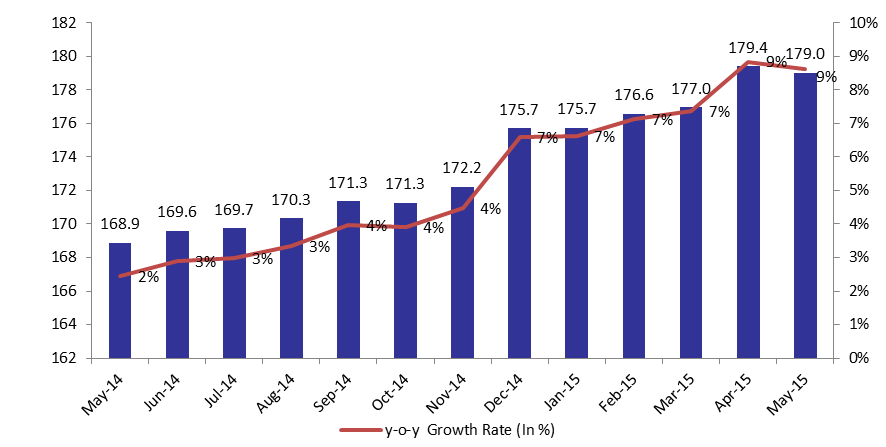

Total consolidated assets of commercial banks amounted to $179.03B by May, a 1.90% growth since year start, and an improvement of 6.97% year-on-year (y-o-y).

In terms of assets, total reserves, with a weight of 36.44%, grew by 4.38% year-to-date (y-t-d) to $66.69B by the fifth month of the year. Loans to the private sector, which constituted 28.69% of total assets, edged up by 0.92% y-t-d to $51.37B by May. This was due to the respective 3.41% and 0.12% y-t-d increases in private sector loans denominated in local and foreign currencies to $12.86B and $38.51B, . Accordingly, the dollarization of private sector loans went from 75.56% by the end of 2014 to 74.96% by May 2015. During the same period, claims on the public sector, constituting 21.46% of total assets, also augmented by 2.18% y-t-d to settle at $38.17B by May. As a matter of fact, Eurobonds increased by 6.81% to $17.42B partly due to the $2.2B Eurobond issuance in February, and which was partially offset by the 1.31% decline in T-bills to $20.66B, from the beginning of the year.

On the liabilities side, resident private sector deposits (64.80% weight in total liabilities) improved by 2.11% since December 2014 to $116.54B by May this year. Thus, the dollarization rate of resident and non-resident private sector deposits slid from 65.71% in December 2014 to 65.15% by May, as private LBP deposits grew at a pace of 4.06% y-t-d to $51.53B, faster than the 1.54% y-t-d growth to $96.36B of foreign private sector deposits.

Commercial Banks’ Assets By May