The newly appointed king Salman reshuffled several power positions in the Kingdom. After Prince Muqrin relinquished the title of crown prince, Muhammad Bin Nayef was appointed to the role. As for the second position in line to the throne, it was designated for Prince Mohammed Bin Salman, the current king’s son who is also assuming the functions of defense minister, secretary general of the royal court and head of the Council for Development and Economic Affairs. The foreign minister Prince Saud al-Faisal was also replaced by Adel Al Jubeir, Saudi Arabia’s ambassador to the US.

On the economic front, Saudi Arabia’s Purchasing Managers’ Index (PMI), reflecting the performance of the non-oil private sector, slumped to its lowest level in six years during the second quarter of 2015 (Q2 2015). The gauge went from an average of 58.8 in Q1 2015 to an average of 57.13 in Q2 2015 as the kingdom paddles through a period of low oil prices and through a period of political tension by opposing Shiite Houthi rebels in Yemen. The lower PMI readings still point to an expansion in the Saudi non-oil private sector, but simply at a slower rate.

Inflation remained subdued but edged up from 2.00% in April to 2.1% in May and then to 2.2% in June. The prices of “food and beverages”, holding the largest weight in the consumer price index of 21.7%, grew by a yearly 2.2% in June. Moreover, rental inflation has accelerated over the first few months of 2015 after dipping to 3.2% in March, the lowest in 2015, rental inflation edged up again to reach 4.0% in June.

A recent report by Jones Lang La Salle (JLL) confirms the notion that rents are on the up in the kingdom, growing between 10 to 15% per annum. Renting property has become a more appealing option than purchasing property since borrowers are only allowed to borrow 70% of the property’s sale price which entails a large down-payment. Borrowers are also hesitant to commit to a housing loan since they might face higher repayment costs when and if the US Federal Reserve increases interest rates. According to JLL, since the introduction of the loan-to-value restriction back in November 2014, the volume of villa and apartment transactions shrunk by around 70% and 33%, respectively.

Non-oil exports and imports both decreased in June. Non-oil exports declined by a yearly 21% to $4.1B while imports fell by a yearly 10% to $13.82B. Due to declining oil prices, exports of products of the chemical or allied industriesrecorded a double-digit annual drop of 28% to $1.32B while exports of plastic, rubber and related items also slumped by 22% to $1.31B in June. The downward trend was also seen with imports of machines, equipment and electrical appliances dropping by a yearly 4% to $3.9B in June, with imports of transport equipment and parts falling by 1% to $2.26B and with imports of regular metals decreasing by 35% to $1.35B. The top three export destinations were the UAE, China, Singapore, India, and Egypt. The top three import destinations were China, the USA, Germany, South Korea and Japan.

Saudi Arabia consistently upped its oil output throughout Q2 2015. After the huge leap in Saudi Arabian oil during the month of March, crude oil production rose again to 10,308 million barrels per day (mbpd) in April, to 10,333 mbpd in May and to 10,564 mbpd in June. The kingdom is still upping its production in order to preserve market share in a context of low oil prices and has to tend to local demand which reached an all-time high of 2.98 mbpd in June. According to the Saudi Arabian Monetary Agency (SAMA), the average price of a barrel of Saudi Arabian oil (Arab Light) fell from $62.6 in May to $60.9 in June.

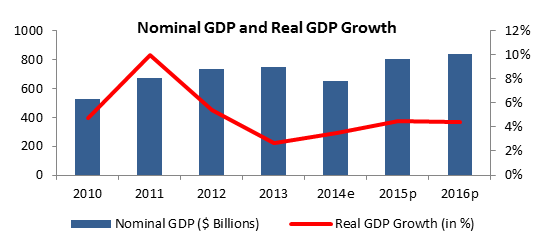

With the absence of regular data regarding government spending and government revenues, bank claims on the public sector serve as an indicator of fiscal policy. According to central bank figures, bank claims on the public sector stopped posting annual double-digit growths since September 2014, after June’s slump in oil prices. Lower oil prices as well as lower non-oil exports continued to reflect on the central bank’s reserve assets. Reserve assets at the central bank declined by an annual 9.5% and a quarterly 3.7% in Q2 2015 to reach $672.11B. In fact, the kingdom is tapping into these reserves in order to continue to fund the spending on wages, projects and the intervention in Yemen. The kingdom used up $65B of reserve assets since oil prices started to fall.

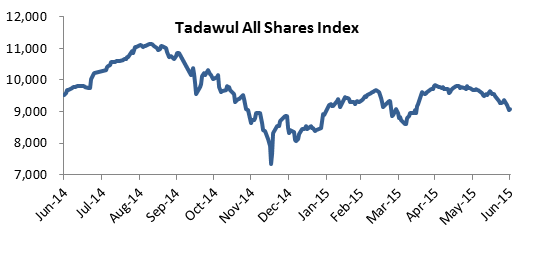

Despite the opening of the bourse to foreigners in June, The TADAWUL All Share Index (TASI) closed at a level of 9,086.89 points in the first half of 2015 (H1 2015), down by 4.48% y-o-y and up by 9.04% y-t-d. The total value of shares reached $278.33B, down by 7.08% y-o-y while the number of traded shares reached 38,783.72 billion shares compared to 38,433.90 billion shares in the same period last year.