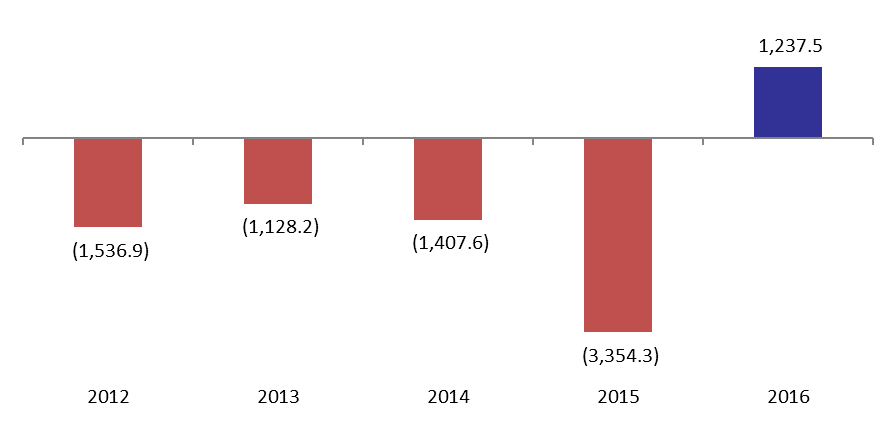

Lebanon’s Balance of Payments (BoP) sealed the year with a $1.24B surplus, compared to a deficit of $3.35B by December 2015. As such, BDL’s Net Foreign Assets (NFA) recorded an increase of $3.87B by December as a result of the Swap it conducted starting June 2016. Meanwhile, commercial banks’ NFAs witnessed a drop of $2.63B since they repatriated part of their foreign currency (FX) liquidity and placed it at the Central Bank as the latter, through the swap operation, offered banks substantial incentives in exchange for their FX liquidity. Hence the banks were compelled to gather additional FX liquidity through sales of Eurobonds but also through the introduction of new high-yielding products to attract foreign deposits.

In December alone, the BoP witnessed a $909.8M surplus. In details, BDL’s NFAs decreased by $234M while that of commercial banks inched up by $1.14B, due to the “window dressing” done prior to the release of end of year results and the entry of foreign currency into the country which usually accompanies the higher tourist arrivals in the festive month of December.

Balance of Payments (BoP) by December (in Millions $)

Source: BDL