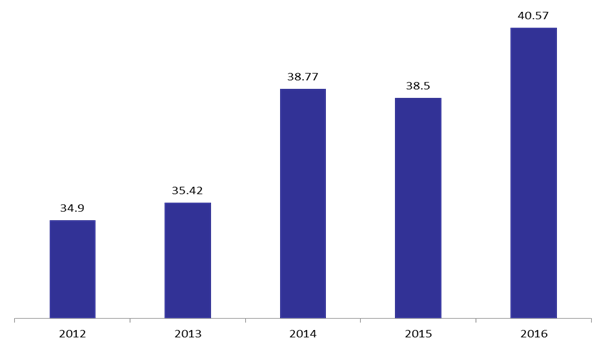

According to Banque du Liban’s Balance Sheet (BDL) , total assets dropped to $103.44B by mid-November 2016 compared to mid-October 2016. Over the same period, Foreign Assets, which represent 39.22% of total assets, declined by 0.5% to $40.57B

The securities portfolio constituted 25.08% of total assets, climbing by 1.08% from mid-October 2016. The increase in the securities portfolio partly offset the decline recorded in foreign assets and stood at $25.94B by mid-November 2016.

The 1.77% decline in gold prices recorded between mid-October and mid-November 2016 subdued BDL’s Gold Reserves by 2.45%, to $11.31B by mid-November 2016.

Loans extended to the Financial Sector constituted 6.03% of total BDL’s assets and BDL extended 3.58% additional loans to the financial sector, with a value of $6.24B. The boosted balance of loans is a good indication.

On the Liabilities side, deposits by the financial sector, representing 80% of the total liabilities, rose by a monthly 0.7% to $83.1B by mid-November 2016.

Constituting 6% of total Liabilities, Public Sector Deposits fell by 10% and stood at $6.14B by mid-Nov.2016.

Foreign Assets by Mid-November ($B)

Source: BDL