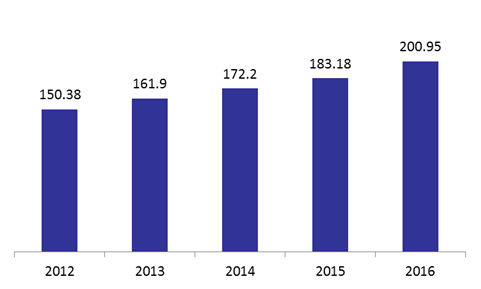

The balance sheet of Lebanese commercial banks revealed an 8.05% year-to-date (YTD) progress in assets and a 9.7% year-on-year increase, to stand at $200.95B by Nov.2016.

In particular, Reserves (44% of total assets) rose by 24.55% YTD to $88.422B largely due to the 24.61% increase in deposits with the Central Bank. Claims on the Resident Private Sector (25% of total assets) also climbed by 5.51%YTD to $50.7B mainly attributed to the 13.56% YTD rise in claims in Lebanese Pounds to $15.5B by Nov.2016.

Claims on the public sector (17% of total assets) and Foreign Assets (11% of total assets) registered YTD declines of 8.15% and 10.38% respectively. Of Foreign Assets, Claims on the Non-residential Financial Sector drove the plunge with a 20.57%YTD decrease to $9.18B. Claims on the Public Sector were dragged down by a 9.12%YTD shortfall to a $16.04B subscription to T-Bills denominated in foreign currencies.

The dollarization ratio for Private Sector Loans shrank from 74.83% in Dec.2015 to 72.79% in Nov.2016.

As for the banks’ liabilities, Resident Private Sector Deposits (63% of total liabilities) and Non-Resident Private Sector Deposits (16% of total liabilities) escalated by 5.33% and 3.87% YTD to $126.1B and $33.09B respectively by Nov.2016.

The dollarization ratio for Private Sector Deposits hiked slightly from 64.88% in Dec.2015 to 65.30% in Nov.2016.

Total Assets of Commercial Banks by November (in $B)

Source: BDL