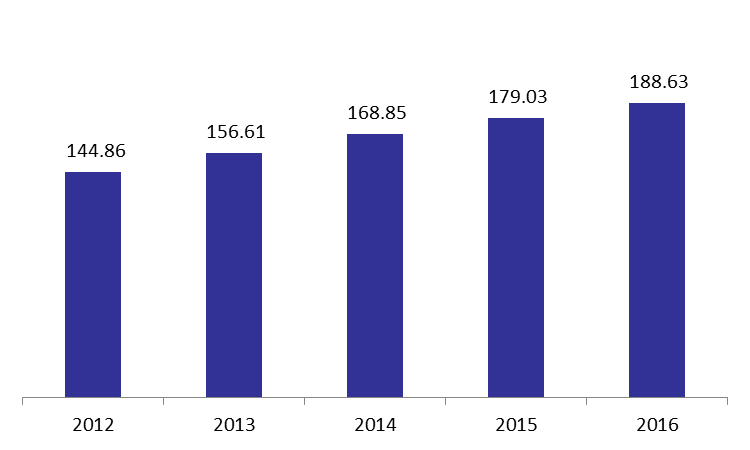

According to Lebanon’s commercial banks’ balance sheet, total assets witnessed a y-t-d increase of 1.42% and an increase of 5.36% y-o-y from $179.03B by May 2015 to $188.63B by May 2016.

This y-t-d increase can be mainly justified by the 3.52% and 2.13% increases in reserves and claims on the resident private sector, whose shares of total assets are 38.96% and 26.01%, respectively.

As documented on the balance sheet, reserves increased due to a rise of 3.47% by May 2016 in deposits with central bank, while claims on resident private sector rose due to an increase of 3.53% in claims in Lebanese Pounds from $12.86B to $14.13B.

However, different accounts on the assets side witnessed a drop in the first 5 months of the year. Both claims on public sector and foreign assets decreased by 0.64% and 3.02% by May 2016, respectively. The main reason behind the drop in foreign assets can be attributed to the 9.90% y-t-d fall in claims on non-resident financial sector, while the decrease in claims on public sector is attributed to the lower subscription to treasury bills in LBP.

As for the liabilities side, the increase can be explained by the 1.78% rise in resident private sector deposits (64.60% of total liabilities) from $119.28B in Dec 2015 to $121.86B in May 2016.

Moreover, the Lebanese economy showed more confidence in its local currency, the Lebanese Pound (LBP), as the dollarization ratio for private sector loans decreased from 74.83% in December 2015 to 74.55% by May 2016. The dollarization ratio for private sector deposits dropped over the same period from 64.88% to 64.79%.

Commercial Banks’ Total assets by May (in Billions $)

Source: BDL