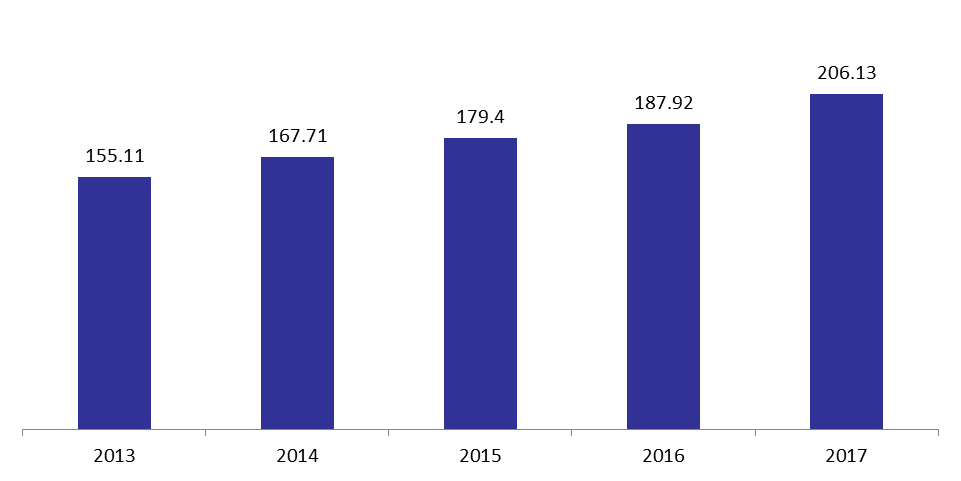

The consolidated balance sheet of Lebanon’s commercial banks revealed a 0.89% year-to-date increase (y-t-d) and a 9.69% year-on-year (y-o-y) advance in total assets to $206.13B.

Claims on the resident private sector increased by 0.97% since year-start to $51.53B with claims denominated in Lebanese Pound advancing at a rate of 4.68% y-t-d to $16.39B and claims in foreign currencies falling by 0.68% y-t-d rate to $35.14B.

Claims on the non-resident private sector dropped by 4.8% y-t-d to $6.05B while claims on the non-resident financial sector increased by 23.51% y-t-d to $13.88B.

Claims on the public sector advanced by 7.70% since year-start to $37.39B with banks’ subscription to treasury bills (in LBP) and Eurobonds respectively rising by 8.69% and 6.63% to $20.86B and $16.4B, on a y-t-d basis.

In terms of liabilities, resident private sector deposits inched up by 1.86% to $130.93B with deposits in LBP edging up by 0.35% to $51.19B and with deposits in foreign currencies adding by 2.86% to $79.74B.

Non-resident private sector deposits rose by 1.75% since year-start to $34.55B with LBP deposits falling by 1.71% since year-start to $4.45B and with foreign currency deposits inclining by 2.28% y-t-d to $30.10B.

The dollarization of private sector deposits rose from 65.82% in December 2016 to 66.38% in April 2017.

Total Commercial Banks’ Assets by April

Source: BDL