Delivery of Plots Boosts Income Statement

Solidere released its consolidated financial statements for the first 6 months of 2016, revealing an improvement in its bottom line from a net loss of $28.71M by H1 2015 to a net profit of $72.10M over the same period this year. During the first half of 2016, Solidere sold 40,000 Built Up Area (BUA), 5,500 sqm of which were in the traditional area, with the remaining portion sold in the Waterfront. The average price per BUA was $3000-$3500.

Total revenues registered $160.67M for the first six months of 2016, compared to $57.84M by H1 2015. The total cost of revenue expanded at a slower pace, ending the period at $41.72M compared to $21.83M. As such, Solidere’s net operating margin improved from 64.35% by June 2015 to a higher 74.45% margin by H1 2016. Solidere is expected to recognize the sale of an additional 30,000 sqm currently held in backlog before the end of the fiscal year. Therefore, Solidere’s sales are expected to surpass the $200M mark for the first time since 2011. Recently, Solidere has been hampered by liquidity issues and lack of investment appetite due to the troublesome local and regional political scene.

Revenue Breakdown by Segment

Revenues from land sales reached $128.90M by June 2016, compared to $26.40M over the same period in 2015. The operating profit margin improved from 74.38% in H1 2015 to 80.04% in H1 2016. Solidere’s Investor Relations (IR) affirmed that all buyers were Lebanese and that the Waterfront plots sold were to be developed both for office and residential purposes.

Revenues from rented properties slightly dipped in value, decreasing 0.89% y-o-y to $27.94M despite occupancy rates remaining stable at 90%, as per Solidere’s IR. A similar dip in rental income operating profit margins from 58.11% by June 2015 to 51.92% over the same period this year is likely linked to some retail rents being waived during H1 2016 and Solidere offering more flexible terms.

Revenues from services rendered by Solidere to its clients, such as the broadband network (BBN), improved 24.24% y-o-y to $3.62M by H1 2016.

Solidere Focus Is Entirely on Existing Projects

Solidere’s current expenditures are divided among the completion of the Waterfront’s infrastructure and the department store, which is scheduled to be completed by early 2018. All other projects are currently put on hold, and will resume among completion of the former two.

Solidere International Succumbs to GCC Stresses

Solidere International Limited, an associate company which Solidere Group owns 39.05% of and which operates mainly in Saudi Arabia and the Emirates, recognized a loss of $6.95M over the first 6 months of 2016. The company is still expected to end the year with a positive bottom line. Solidere SAL’s share of these results is a $2.58M loss.

Balance Sheet Indicates Improved Cash Flow Management

On the balance sheet, Solidere’s total assets remained relatively stagnant, increasing 0.24% y-t-d to $2.92B. It is worth mentioning that net accounts and notes receivables increased by 9.58% y-t-d to $510.89M, as a result of lower provisions taken out for problematic receivables. It is worth mentioning that Solidere’s accounts receivable turnover significantly improved from 2,036 days at end-2015 to 742 days by June 2016, a 5-year low.

On the liabilities side, Solidere managed to decrease its accounts payable from $111.62M by end-December 2015 to $105M by H1 2016. The decrease in liabilities contributed to the decrease of Solidere’s accounts payable turnover to 953 days from a previous 1,249 days at end-2015.

Debt Levels Remain High

Solidere’s bank overdrafts and short term facilities displayed a downward trend, decreasing by 5.32% y-t-d to $526.47M, while the longer term bank loans displayed less of a change, dipping 1.17% to $130.82M over the same period. As such, the company’s annualized implied average interest rate across its short and long term debt is estimated at 5.44%. Solidere paid $18.23M in interest expense during H1.

The company owns a land bank of 1.72M sqm, valued by FFA at roughly $6.68B last year, with income generating projects valued at another $1.4B. FFA was commissioned by Solidere to perform the valuation.

Dividend Distribution for FY 2015

The latest shareholder general assembly on June 27th was concluded with the decision to distribute a dividend share for every 80 shares held, in addition to a cash dividend of 10 cents per share, equivalent to a distribution of approximately 2 million shares, and $16.5M in cash. These dividends were distributed on July 18th, 2016.

Consolidated Financial Highlights

| $M | 2016 | 2015 | Y-o-Y change |

| Net Income* | 72.1 | (28.71) | 351.13% |

| Total Assets | 2,924.37 | 2,917.50 | 0.24% |

| Total Liabilities | 912.49 | 960.01 | -4.95% |

| Total Equities | 2,011.88 | 1,957.49 | 2.78% |

Source: Solidere, Blominvest

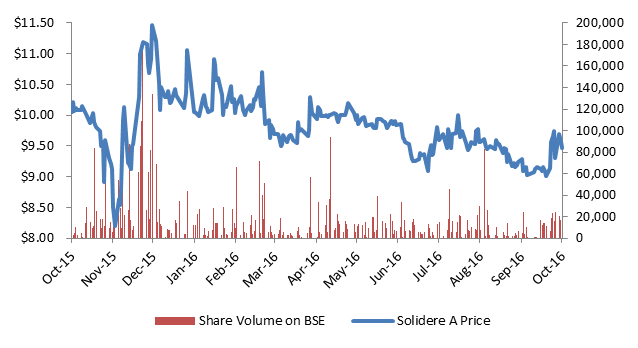

Solidere “A” Share Price and Volume

| Closing Price 05/10/2016 | $9.46 |

| QTD Return | 1.72% |

| 6-Month Return | -4.73% |

| YTD Return | -14.47% |

| 52-Week Range | $8.20-$11.47 |

Source: Reuters, Blominvest