The recently released balance sheet of Bdl revealed substantial interim drops in the levels of foreign assets and securities’ portfolio, between mid-March and the end of March. The decline in foreign assets reached $919.15M and came on the back of the $1.5B maturing Eurobonds in the second half of March, and which were mainly held by foreign investors. In fact, Lebanese banks had to sell a large part of their Eurobonds’ holdings to foreign entities in order to participate in the last financial engineering of BdL, which brought in fresh money to the market. However, whether this drop will result in a deficit in the Balance of Payments will depend on the evolution of the commercial banks’ balance sheet at the end of March 2017, which needs another month to become available.

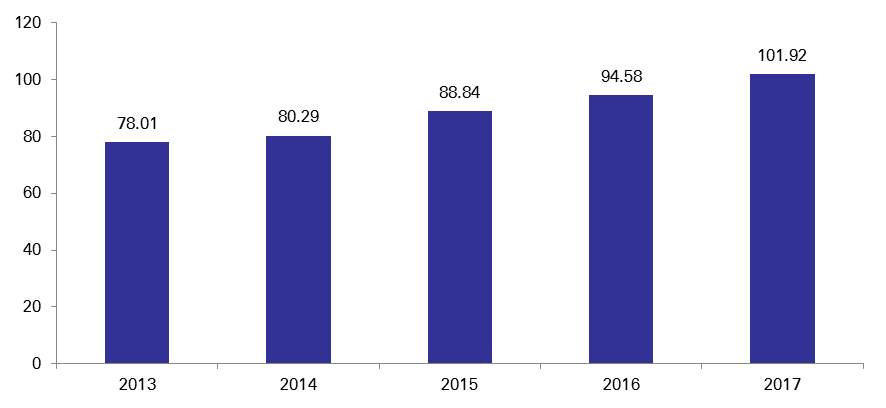

The balance sheet of the Lebanese Central Bank (BdL) revealed a 0.39% year-to-date (y-t-d) downtick in total assets to $101.92B in March 2017 on the back of decreasing foreign assets and securities’ portfolio. Hence, foreign assets (constituting 39% of BdL’s total assets) witnessed a 1.5% drop since the beginning of the year to $40.09B, while the securities’ portfolio (24% of total assets) registered a y-t-d downturn of 6.2% to $24.24. Similarly, loans to the financial sector (6% of total assets) fell 8.7% in the first quarter of 2017 to $5.84B. However, gold assets at BdL maintained their upward trend recording a 7.1% rise over the same period to $11.47B.

On the liabilities side, financial sector deposits, with an 80% stake of total liabilities, dropped 3.3% during the same period to $81.42B. Public sector deposits (7% of total liabilities) edged up by 21% to reach $6.67B in March 2017.

BDL’s Total Assets in March (in $B)

Source: BDL