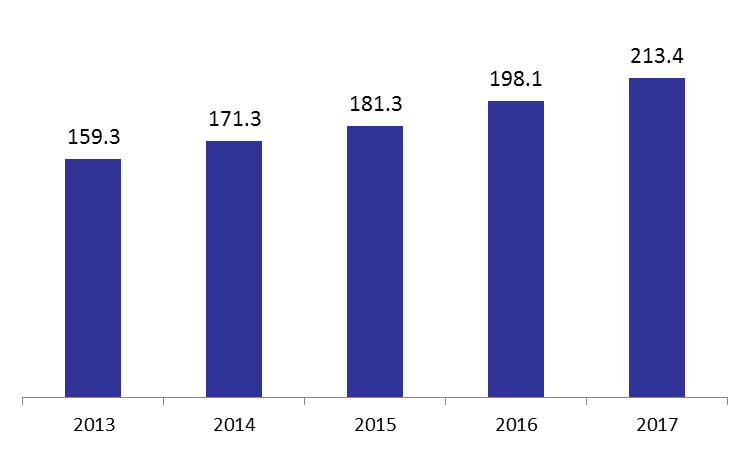

The balance sheet of Lebanon’s commercial banks revealed that total assets grew 4.5% year-to-date (y-t-d) and 7.8% year-on-year (y-o-y) to reach $213.4B by Sept. 2017.

The rise can be attributed to the respective y-t-d increases of 11.2% and 3.9% in Reserves (46.8% of total assets) and Claims on the resident private sector (24.9% of total assets ) to stand at $99.8B and $53.0B, respectively. In details, by Sept. 2017, Reserves grew on the back of an 11.1%y-t-d rise in Deposits with the central bank, while the higher Claims on resident private sector owe it to the 11.2% growth in Lebanese Pounds Claims since the beginning of the year, to stand at $17.4B.

Nonetheless, Claims on the public sector and Foreign assets recorded downticks of 4.6% and 6.5% by Sept. 2017, to reach $33.1B and $21.6B, respectively. In fact, the decrease in Claims on the public sector was driven by lower subscriptions to treasury bills denominated in Lebanese pounds (LBP), which slipped by 8.2% since the beginning of the year to stand at $17.6B by Sept.2017. In its turn, the drop in Foreign assets came on the back of a 9.8% y-t-d decline in Claims on the non-resident financial sector, which settled at $10.1B by Sept. 2017.

On the liabilities side, Resident private sector deposits, (constituting 63% of total liabilities), grew by 4.4% y-t-d to reach $134.2B by Sept. 2017.

The dollarization ratio for private sector deposits slightly rose from 65.82% in December 2016 to 66.9% in Sept. 2017.

Total Assets of Commercial Banks by Sept. (in $Billions)

Source: Banque Du Liban