According to the Ministry of Finance (MOF), treasury transfers to EDL (Debt service and reimbursement of gas and fuel purchases) totaled $819.8M in the first eleven months of 2016, 22.3% lower than the same period last year. This decline came as a result of lower payments for EDL’s debt service (C-loans and Eurobonds) and, purchase of gas and fuel, with the former dropping by 29.5% year-on-year to $13.2M and the latter slipping by 22.2% to $806.6M up to November. According to the MOF’s report, it is worth mentioning that “the C-loans are fully amortized so no debt service will be recorded starting October 2016”. In fact, C-loans belong to institutional term loans, which are facilities destined for nonbanks and institutional investors. These loans are priced higher than amortizing term loans because they have longer maturities and bullet repayment schedules.

Payments to the two gas and fuel suppliers, the Kuwaiti KPC (Kuwait Petroleum Corporation) and the Algerian Sonatrach went down due to the continuous contraction of global crude oil prices.

Oil payments disbursed in January-November 2016 were made at an average crude oil price of $43.05/barrel whereas payments disbursed in January-November 2015 were made at price of $53.32/barrel.

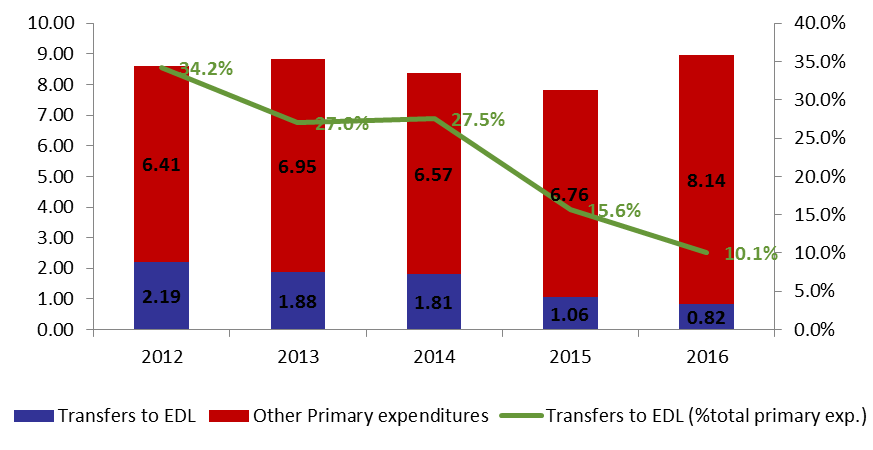

EDL’s contribution to the oil bill stood at 6.0% up to November 2016 as compared to 4.4% up to November 2016. However, transfers to EDL represented 9.2% out of the $8.96B primary expenditures in the first eleven months of 2016 compared to a higher stake of 13.5% in the parallel period of 2015 when primary expenditures valued $7.81B.

Transfers to EDL out of Primary Expenditures (In $B)

Source: Ministry of Finance