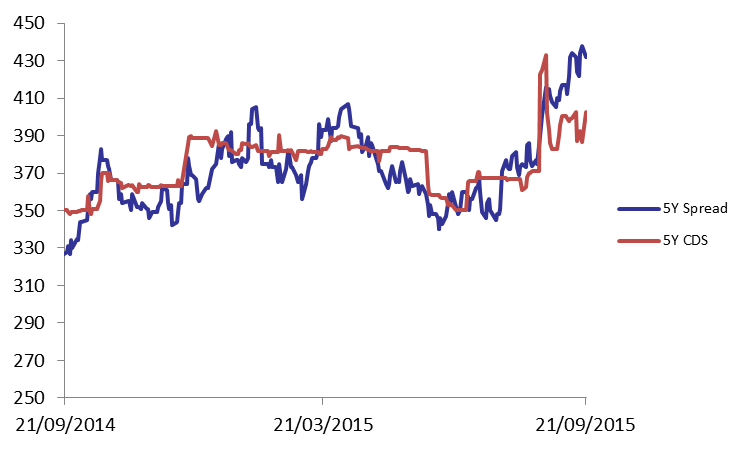

Demand for Lebanese Eurobonds barely changed to start the week as uncertainty regarding the Lebanese political outlook is keeping investors on edge. Accordingly, the BLOM Bond Index (BBI) steadied at 105.72 points, registering a year-to-date loss of 1.63%. Yield on the 5Y and 10Y Lebanese Eurobonds remained at their previous levels of 5.83% and 6.35%, respectively. Demand for medium-term US notes weakened on Monday, causing the 5Y spread between the 5Y Lebanese and US notes to narrow by 6 basis points to 432 bps. As for the Lebanese 5Y Credit Default Swaps (CDS), they broadened from their previous quotes of 373-400 bps to 390-415 bps.

| Last | Previous | Change | Y-t-D Change | ||

| BBI | 105.722 | 105.722 | 0.0% | -1.63% | |

| Weighted Yield | 5.74% | 5.74% | 0 | bps | |

| Duration (Years) | 4.97 | 4.98 | |||

| 5Y Bond Yield | 5.83% | 5.83% | 0 | bps | |

| 5Y Spread* | 432 | 438 | -6 | bps | |

| 10Y Bond Yield | 6.35% | 6.35% | 0 | bps | |

| 10Y Spread* | 415 | 422 | -7 | bps | |

*Between Lebanese and U.S notes

| Price | Yield | Yield Change (in bps) | |

| Nov. 2016 | 100.58 | 4.21% | 1 |

| Mar. 2017 | 106.25 | 4.63% | -2 |

| Oct. 2017 | 100.38 | 4.80% | 0 |

| Jun. 2018 | 100.38 | 5.00% | 0 |

| Nov. 2018 | 100.13 | 5.10% | 0 |

| Apr. 2019 | 100.75 | 5.27% | 0 |

| May. 2019 | 102.25 | 5.31% | 0 |

| Nov.2019 | 100 | 5.45% | 0 |

| Mar. 2020 | 103.13 | 5.57% | 0 |

| Apr. 2020 | 100.75 | 5.61% | 0 |

| Apr. 2021 | 110.88 | 5.93% | 0 |

| Oct. 2022 | 100.5 | 6.01% | 0 |

| Jan. 2023 | 99.63 | 6.06% | 0 |

| Dec. 2024 | 105.25 | 6.24% | 0 |

| Feb. 2025 | 99.5 | 6.27% | 0 |

| Jun. 2025 | 99.5 | 6.32% | 0 |

| Nov. 2026 | 100.75 | 6.50% | 0 |

| Nov. 2027 | 101.5 | 6.57% | 0 |

| Feb. 2030 | 99.75 | 6.68% | 0 |

/accordion_section]

/accordion_section]