According to “Al Iktissad wal Aamal”, before the end of June, The Central Bank of Lebanon is expected to issue a new circular regarding the establishment of a fund for Real Estate Lending.

This new financial engineering initiative comes in the context of stagnation in the real estate sector, one that has been amplified in the past two years and one that affects banks and the economy as a whole.

Simply put, with this fund, the private sector will be able to buy buildings and apartments from real estate developers who are facing low or stagnant demand and who are indebted to banks.

This private sector participation will represent 40% of the fund’s capital while the remaining 60% will be in the form of bonds that can be traded on the market or discounted at the Central Bank.

This fund benefits all its stakeholders. First, the buyers from the private sector will be able to buy residential apartments at attractive prices which are surely lower than the listed market prices.

For the real estate developers, the participation of the private sector will ease their debt burden substantially. The liquidation of some of their fixed assets will in turn allow them to meet the commitments of their existing contracts and perhaps access new lines of credit.

The fund will also allow banks to deal with their non-operating loans that may turn into doubtful loans and therefore will spare them the need to take provisions and will allow them to boost their profitability.

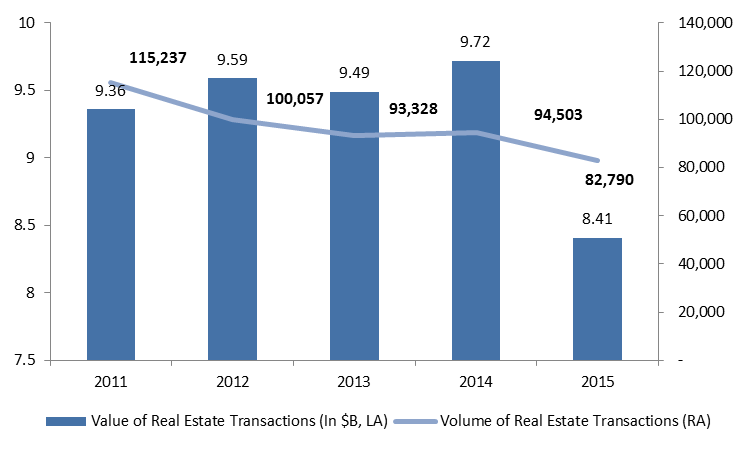

Volume and Value of Real Estate Transactions

Source: Cadastre