According to Moody’s latest report, the outlook for the Lebanese banking system remained negative. The negative outlook was maintained as the rating agency believes that first, economic conditions will remain precarious in the period ahead, and second, that the banks’ high and growing exposure to the sovereign represents a source of credit risk.

Moody’s forecasted GDP for 2016 is 1.7%, up from 1.3% in 2015 but still far below the 9% average recorded during the period 2007-2010. The agency also expects the budget deficit to remain elevated at 8% of GDP for 2016-2017. Moody’s acknowledges that lower oil prices have boosted the disposable income of Lebanese consumers but also highlights that a sustained drop in oil prices will negatively impact capital inflows from the Gulf. The overall difficult operating environment drove Moody’s to expect a lending growth below 6% in 2016 as opposed to an average annual credit growth of 24% in 2007-2010.

In regards to Lebanese banks’ direct exposure to sovereign debt, it is estimated at 2.5 times their Tier 1 capital as of March 2016. This exposure is eventually what links the creditworthiness of Lebanese banks to that of the Lebanese government.

However, Moody’s believes that capital levels will remain stable on account of “the implementation of Basel III, profit retention and limited asset growth”. “Profits will also remain stable but muted owing to limited new business generation and elevated loan-loss provisioning”. The banking system’s stability will remain supported by solid liquidity buffers and the loyal base of depositors, especially the Lebanese diaspora.

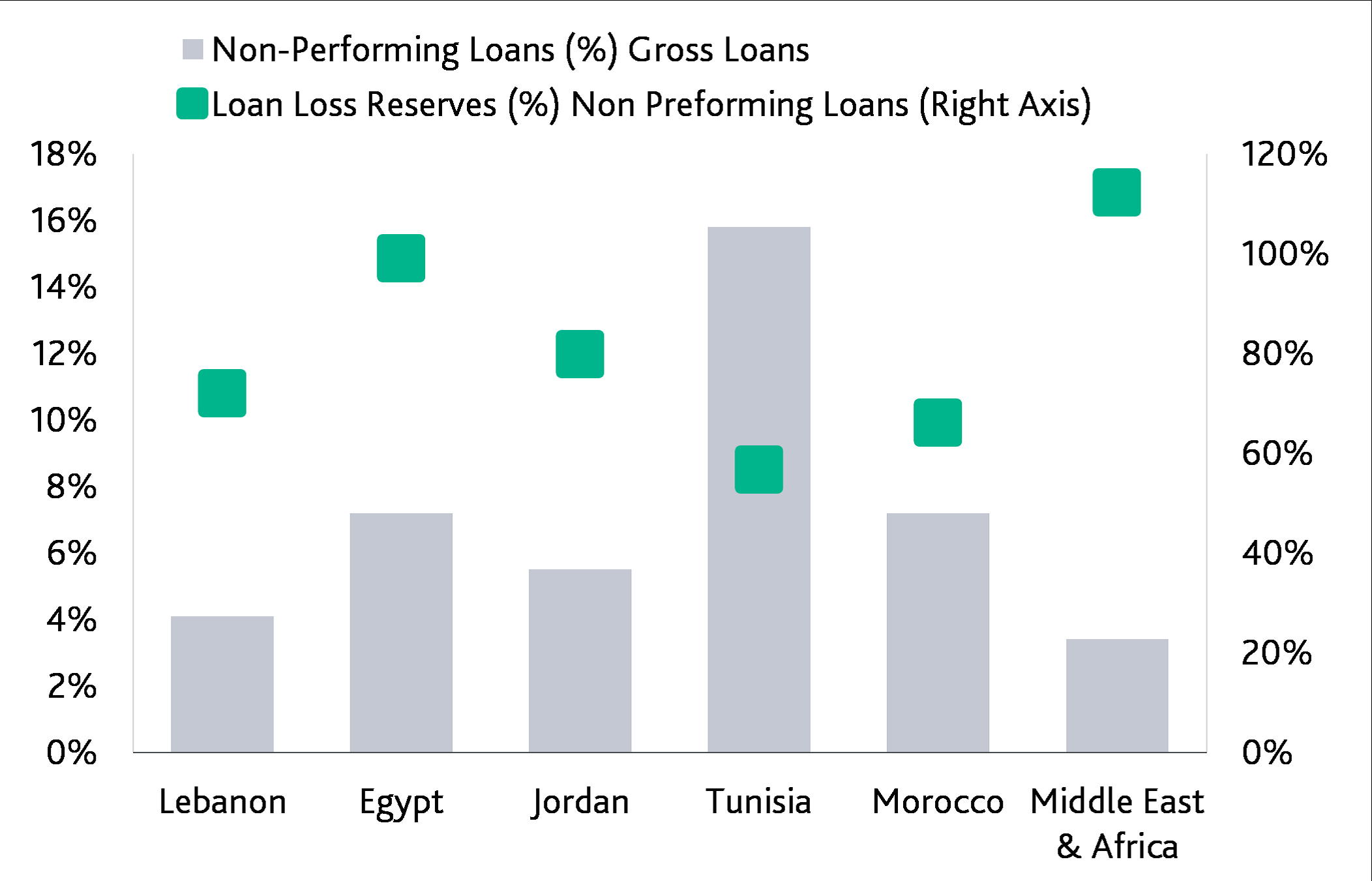

The Loan Quality of Lebanese Rated Banks Remains below the Region’s Peers in Spite of Difficult Operating Conditions

Source: Moody’s

Note: Lebanon as of December 2015, Egypt as of September 2015, Jordan and Morocco as of June 2015 and Tunisia as of March 2015