The era of low oil prices compelled the Kingdom of Saudi Arabia to identify the challenges that lie ahead and to determine an action plan drafted under the wing of the Saudi Arabia Vision 2030. The Kingdom released an extensive program called the “National Transformation Program” (NTP), in which ministries and government bodies announce their objectives for the period 2016-2030 and subject themselves to a close monitoring of their performance in fulfilling those objectives.

Aside from strengthening the non-oil economy, the NTP also sets out to tackle other important issues in the Kingdom. On the agenda, enhancing the quality of the judicial system but ensuring access to affordable housing which has been a lingering problem for Saudi Arabia. According to the NTP, in the baseline, the share of real estate financing in gross non-oil national product is at 8%, below the regional benchmark of 16% but the Kingdom is aiming to reach a ratio of 15% by 2020.

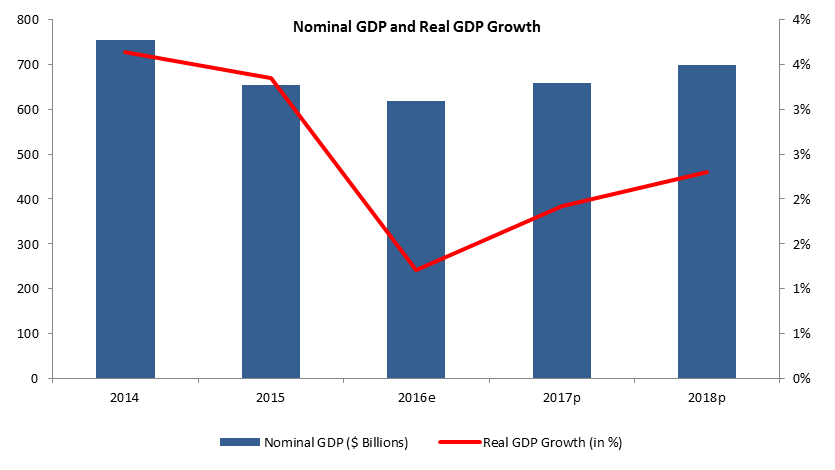

The slowdown in the government spending reflected on overall GDP and overshadowed the upturn in the oil sector. Real GDP growth decelerated to 1.54% in Q1 2016 compared to 3.27% in the same quarter last year. The slowdown in growth occurred despite the acceleration of growth in the oil sector from 0.21% in Q1 2015 to 5.14% in Q1 2016. The growth in the oil sector is in line with the kingdom’s strategy of maintaining its market share on the oil market as it increased crude oil production from 29.61 million barrels per day in Q1 2015 to 30.67 million barrels per day in Q1 2016.

The NTP will surely prove to be a challenge for Saudi Arabia with the non-oil sector posting its worst performance in at least five years in the first quarter of 2016 (Q1 2016). The non-oil sector regressed by 0.67% in Q1 2016, solely on account of a 2.58% decline in the government sector’s GDP. Given the drop in oil prices the government was forced to cut back on spending: in nominal terms, the final government consumption expenditure dropped from $54.18M in Q1 2015 to $37.81M in Q1 2016.

The private sector, which the NTP sets out to strengthen, proved to be resilient in spite of the drop in oil prices. For the second quarter of 2016 (Q2 2016), the Emirates NBD Purchasing Managers’ Index (PMI) improved, moving up from an average of 54.27 in Q1 2016 to 54.47 in Q2 2016. In May, the gauge reached a six-month high of 54.8 on account of the fastest rise in new work for 2016.

The Gross Domestic Product (GDP) of the private sector posted a timid real growth in the first months of the year (Q1 2016). According to the national accounts, the real private sector growth stood at 0.21% in Q1 2016 compared to 3.01% in Q1 2015. The nominal private GDP amounted to $82.24B in Q1 2016 up from $81.8B in Q1 2015.

The external sector assumed a downward trend during Q1 2016. Non-oil exports of Saudi Arabia amounted to 41,973 million riyals in the first quarter (Q1) of 2016 as compared to 47,742 million riyals in the corresponding period of the previous year, down by 5,768 million riyals or 12.1%. Total imports amounted to 14,051 million riyals in Q1 2016 as opposed to 163877 million riyals in the same period of 2015. Accordingly, the current account deficit represented 11.9% of GDP in Q1 2016 up from 6.5% in Q1 2016.

The reduction of the Saudi economy’s dependency on oil is the most prominent objective ahead. The Kingdom is aiming to move from 163.5 billion SAR of non-oil revenues in the baseline to 530 billion SAR in 2020. Since low oil prices will exercise substantial pressure on the kingdom’s public finances, spending is being put on a more sustainable and efficient path. The Kingdom is aiming to reduce the shares of salaries and wages in the total budget from 45% in the baseline to 40% in 2020, the equivalent of a drop from 480 billion SAR in the baseline to 456 billion SAR in 2020. Debt is also targeted to be put on a sustainable yet upward path, rising from 7.7% of GDP in the baseline to 30% in 2020.

Saudi Arabia is continuing to pull out cash from foreign securities as it needs to finance the budget deficit. According to SAMA, the country’s central bank, investments in foreign securities fell from $400.28B in December 2015 to $367.20B in June 2016. This redemption was mirrored by SAMA’s total reserve assets which fell from $616.42B in December 2015 to $570.06B in June 2016.

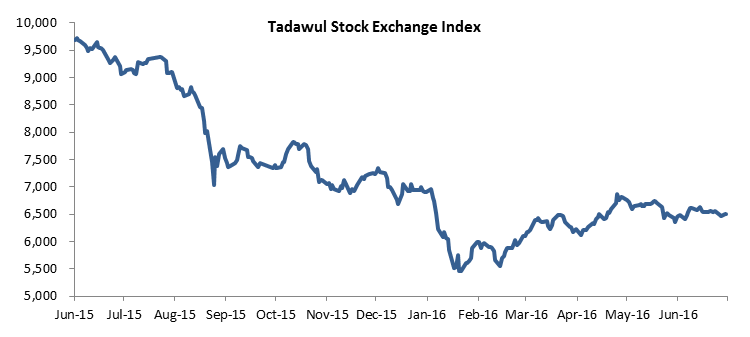

The equity market posted a negative performance in H1 2016 with the Tadawul Stock Exchange Index (TASI) losing 6% since year start to reach 2,587.01 points. The market capitalization totaled $401.16 billion while the volume and value of traded shares amounted to 38.74 billion and $183.52 billion, respectively. The most notable corporate action on the market was the acquisition led by Al-Tayyar Travel Group Holding Co. of a 40% share in Equinox Group for $2.13 million. Equinox Group is a project consulting and asset management company in the hospitality sector.