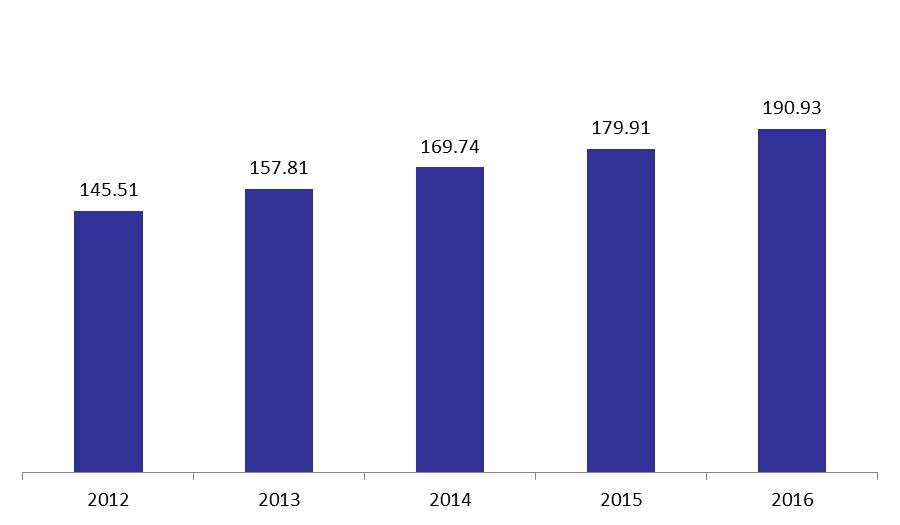

According to Lebanon’s commercial banks’ balance sheet, total assets grew 2.66% year-to-date (y-t-d) and 6.12% y-o-y, from $179.91B by July 2015 to $190.93B by July 2016.

The main drivers behind the y-t-d rise were the 8.64% and 3.17% respective increases in reserves (40.40% of total assets) and claims on the resident private sector (25.96% of total assets ) to $77.13B and $49.57B, respectively. In details, by July 2016, reserves escalated due to a rise of 12.49% in vault cash, while claims on resident private sector increased due to the 5.98% growth in claims in Lebanese Pounds to $14.46B.

However, claims on public sector and foreign assets witnessed respective falls of 3.36% and 6.63% by July 2016. The main reason behind the drop in foreign assets was the claims on non-resident financial sector that dropped 17.05% y-t-d to $9.48B, while the decrease in claims on public sector is justified by the lower subscription to treasury bills in LBP, that plummeted by 15.36% since the beginning of the year to $16.98B.

On the liabilities side, resident private sector deposits, which grasp two-thirds of total liabilities, grew 2.52% from $119.73B in Dec 2015 to $122.74B in July 2016.

The dollarization ratio for private sector loans decreased from 74.83% in December 2015 to 74.20% in July 2016, and the dollarization ratio for private sector deposits slightly fell from 64.88% in December 2015 to 64.87% in July 2016.

Commercial Banks’ Total assets by July (in Billions $)

Source: BDL