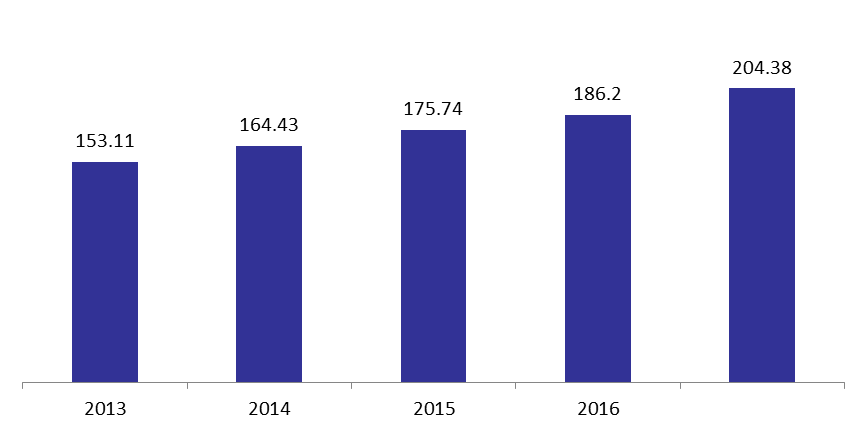

According to Lebanon’s commercial banks’ balance sheet, total assets increased by 9.76% annually to $204.38B by January 2017.

In details, reserves increased by 23.80% y-o-y to $88.52B due to a growth of 23.93% in deposits with central bank. Moreover, claims on resident private sector rose 5.53% to $50.84B due to the 14.89% incline in claims in Lebanese Pounds to $15.77B.

Nevertheless, both claims on public sector and foreign assets observed respective drops of 4.53% and 0.79% by January 2017 to $36.15 and $23.13B, respectively. The main component behind the decline in foreign assets was claims on non-resident private sector that dropped 1.70% y-o-y to $6.11B, while the decrease in claims on public sector is mainly attributed to the lower subscription to Eurobonds that dropped by 15.10% since January 2016 to $15.42B.

As for the liabilities, a 7.74% rise in resident private sector deposits to $128.76B lead to the substantial increase in the account in January 2017.

Moreover, the dollarization ratio for private sector loans decreased from 74.76% in January 2016 to 72.31% in January 2017, and the dollarization ratio for private sector deposits slightly rose from 64.67% in January 2016 to 65.84% in January 2017.

Commercial Banks’ Total assets in January (in Billions $)

Source: BDL