The report analyzes and sums up the key international, regional, and domestic developments that impacted the performance of Lebanese Eurobonds in the first half of 2017. The points developed in this report are highlighted below:

In the US, the Bloomberg Index of US Treasuries grew by an incremental 1.88% y-t-d to 126.47 points at end-June, reflecting a cautious demand for US treasuries during H1 2017.

In Q1 2017, strong economic data favoured equity investments. Trump’s pledge to infrastructure spending kept markets optimistic, thus boosting equity investments. […]

Shifts in the FED’s policies during Q2 2017 ended H1 with a higher US treasuries index. In Q2, with Trump’s unfulfilled (postponed) promises on multiple fronts, and as inflation kept on softening, the demand on government bonds improved and the index rose by 1.18% quarter-on-quarter (q-o-q). […]

In Europe, the economic growth kick-off mainly sent managers to rebalancing portfolios into equity investments. Therefore, the demand on bonds declined in H1 2017 as the Bloomberg Eurozone Sovereign Bond Index lost 0.73% y-t-d. […]

The new monetary stances of the ECB and FED in H1 were partly behind the increasing demand for emerging markets’(EM) sovereign bonds. Over the period, the JP Morgan Emerging Markets Bond Index posted an annual 6.2% gain to settle at 784.9 points by June 2017.[…]

In its turn, the KSA marked H1 2017 with its second large tapping of international bond markets via Sukuks. Following a crash in oil prices that afflicted the country’s budget surplus, Saudi Arabia was forced to reshape its oil-dependent economy, slashing spending and tapping international bond markets for a second time in April 2017 […]

The recent diplomatic crisis highlighted Qatar’s economy in H1 2017 but did not change the country’s bonds status. […]

H1 2017 marked a fluctuating performance of Lebanese Eurobonds. […]

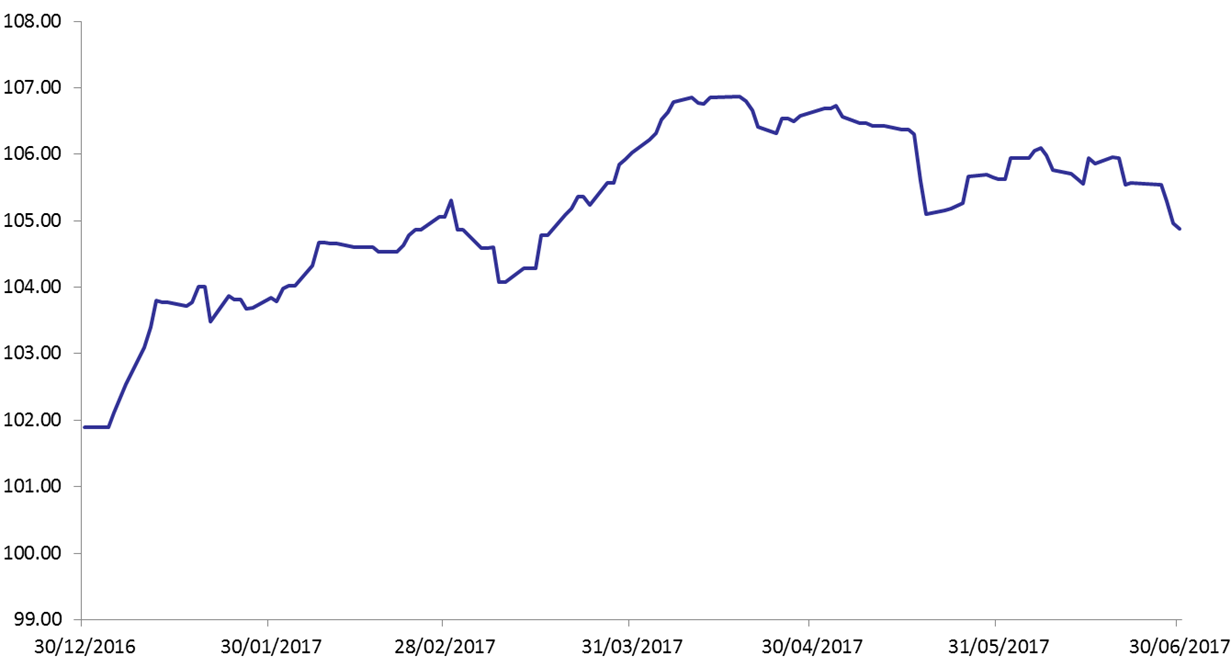

Performance of the BLOM Bond Index (BBI) in H1

Source: BLOMINVEST Bank

The weighted average yield of Lebanese Eurobonds, inversely related to price, fell from 6.67% on Dec.30, 2016 to 6.15% on June 30, 2017.

Participation of foreign investors in the new issue drove the demand for Lebanese Eurobonds up in H1.

According to the MoF, the Issuance was 6 times oversubscribed, reaching $17.8B, of which $1.25B came from “foreign” investors including banks and financial institutions. These snapped a total of 20% of the issuance, equivalent of $600M, one of the highest recorded for Lebanon. […]

However, demand on Eurobonds lost momentum in Q2 2017. […] The wait-and-see negotiations period prompted the BBI to slip by 0.89% and 0.7% in May and June 2017, respectively. […]

Looking forward: Lebanese Eurobonds and debt

The MoF’s large issuance was performed to finance a magnified public debt rated “B2 (negative)” by Moody’s who emphasized, “the country’s resilient liquidity position, very high debt burden, and deteriorating fiscal deficit” in its May 2017 report. […]

Overall, the performance of Eurobonds by June 2017 improved owing it to the overcoming of 1 of the 2 major hurdles facing Lebanon. […]

To read more on Eurobonds in H1 2017, kindly click on the link below:

Lebanese Eurobonds amid International Bond Markets in H1 2017