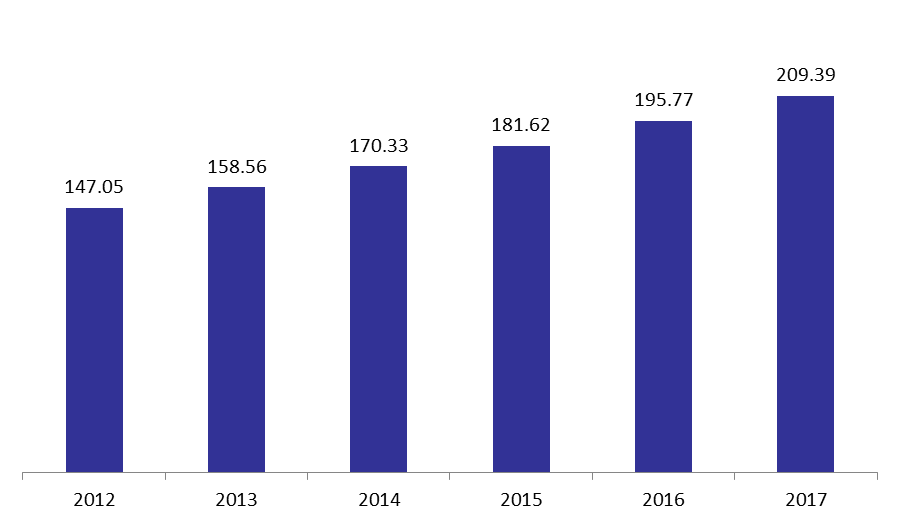

According to Lebanon’s commercial banks’ balance sheet, total assets grew 2.04% year-to-date (y-t-d) and 6.95% y-o-y, to $209.39B by August 2017.

The reason behind the y-t-d rise in assetswere the 5.90% and 3.59% respective increases in reserves (45.40% of total assets) and claims on the resident private sector (25.25% of total assets ) to $95.05B and $52.87B, respectively. In details, by August 2017, reserves escalated due to a rise of 5.88% in cash, while claims on resident private sector increased due to the 10.43% growth in claims in Lebanese Pounds to $17.09B.

However, claims on public sector and foreign assets witnessed respective falls of 3.48% and 4.48% by August 2017 to $33.51B and $22.07B. The drop in foreign assets was due to 4.7% y-t-d slip in the claims on non-resident financial sector to $10.71B, while the decrease in claims on the public sector is justified by the lower subscription to treasury bills in LBP, that fell by 10.79% since the beginning of the year to $17.12B.

On the liabilities side, resident private sector deposits, which grasp 64% of total liabilities, grew 4.37% to $134.16B in August 2017.

The dollarization ratio for private sector deposits slightly rose from 65.82% in December 2016 to 66.92% in August 2017.

Commercial Banks’ Total assets by August (in Billions $)

Source: BDL