The balance sheet of the Lebanese Central Bank (BdL) revealed that total assets reached $128.79B in mid- June 2018, recording a 2.8% increase from Mid-May’s 2018 level.

Foreign assets, constituting 35% of total assets, added 6.3% on year-to-date (y-t-d) basis to settle at $44.63B by mid-June 2018. However, securities’ portfolio (22% of the total assets) dropped by 3.2% over the same period to reach $28.31B, which is mostly linked to the $3.02B Eurobonds sale done by BDL by the end of May. The value of gold reserves (9% of total assets) recorded a marginal change of 0.6% between December 2017 and Mid-June 2018 to reach $12.03B. This minimal change in gold reserves’ was mirrored by the minor 1.7% y-t-d drop in gold prices to 1,279$ as of mid-June 2018.

As for loans to the financial sector (18% share of total assets), they witnessed a substantial increase of 17.7% y-t-d to $22.8B in mid- June 2018. This can also be explained by the Eurobonds sale process that took place by the end of May when the commercial banks discounted certificates of deposit in US dollars held in their portfolios to cover the cost of acquired Eurobond. In parallel, BDL provided loans with low interest rates at 2% in Lebanese pound to the banks and agreed with banks to deposit 125% of the amounts the former granted them at a 10.5% interest to be blocked over the next 10 years.

On the liabilities side, financial sector deposits, with a share of 82% of the total, went up by 8.4% during the same period to $105.67B. Similarly, public sector deposits (5% of total liabilities) sharply increased by 16.3% to reach $6.86B in June 15, 2018.

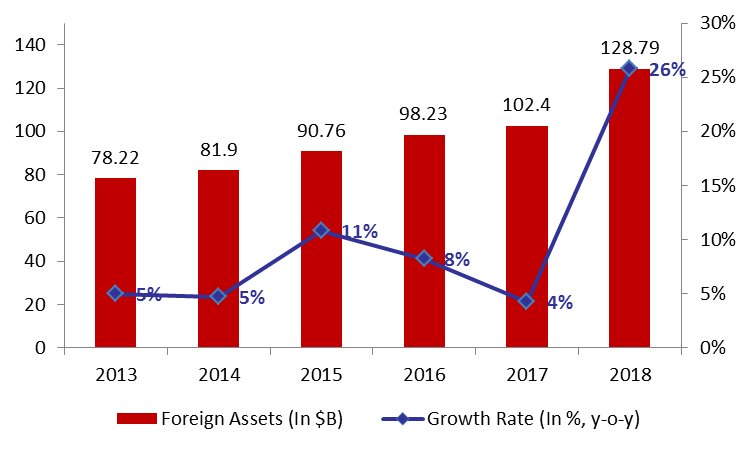

BDL’s Total Assets in mid-June (in $B)

Source: BDL