According to Lebanon’s consolidated commercial banks’ balance sheet, total assets grew by 8.46% year-to-date (y-t-d), to stand at $238.46B by August 2018.

In details, Currency and deposits with BDL (constituting 50.96% of total assets) recorded a 16.93% y-t-d uptick to settle at $121.52B by August 2018. The increase came on the back of a 16.89% y-t-d climb in deposits with the central bank (BDL) which stood at $120.8B by August 2018. In fact, the BDL is offering banks products with attractive returns in order to withdraw liquidity from the market as it is adopting a contractionary monetary policy.

Meanwhile, Claims on resident customers (21.90% of total assets) declined by 2.29% y-t-d to stand at $52.23B by August 2018. In details, the claims in foreign currencies decreased by 3.79% y-t-d to settle at $34.69B. Claims on non-resident customers (2.79% of total only) rose by 9.46%. However, it is worth mentioning that the claims on LBP for the non-resident customers increased by 33.45% Y-T-D . This can be linked to the fact that BDL is still offering the subsidy on housing loans in LBP for non- residents customers aiming at encouraging capital inflows.

As for the residents securities portfolio they grew by 6.27% since the beginning of the year to reach $35.45B noting that subscriptions to Eurobonds climbed by 16.66% to $16.54B by August 2018. Meanwhile, banks subscription to T-bills decreased by 3.34% y-t-d to $17B.

On the liabilities side, Resident customers’ deposits (which grasp 56.78% of total liabilities) witnessed a short uptick of 1.62% y-t-d to $135.37B by August 2018 compared to 4.37% growth rate during the same period last year. In details, deposits in LBP added 1.10% y-t-d to $48.96B and constituted 36.16% of total resident deposits while deposits in foreign currency climbed by 1.91% y-t-d to $86.43B and constitute 63.3% of total resident deposits.

As for the Non-resident customers’ deposits (15.38% of total liabilities), they increased by 4.32% y-t-d and totaled $36.67B over the same period on the back of deposits in foreign currencies (constituting 87.27% of total non-resident deposits) recording a growth of 3.63% . As such, the dollarization ratio for private sector deposits slightly rose from 68.72% in December 2017 to 68.80% in August 2018.

In their turn, Non-resident financial sector liabilities grew by 14.35% y-t-d, to $8.56B by August 2018 which further explains banks’ borrowings being partly used to subscribe to BDL’s offerings.

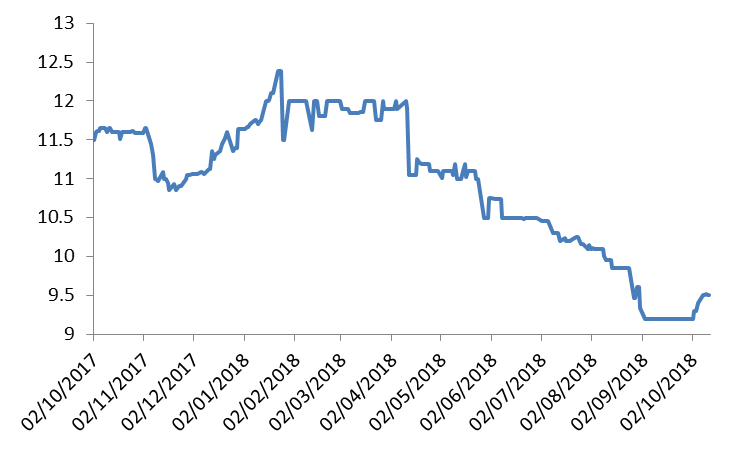

Commercial Banks’ Total assets by August (in $Billions)

Source: BDL