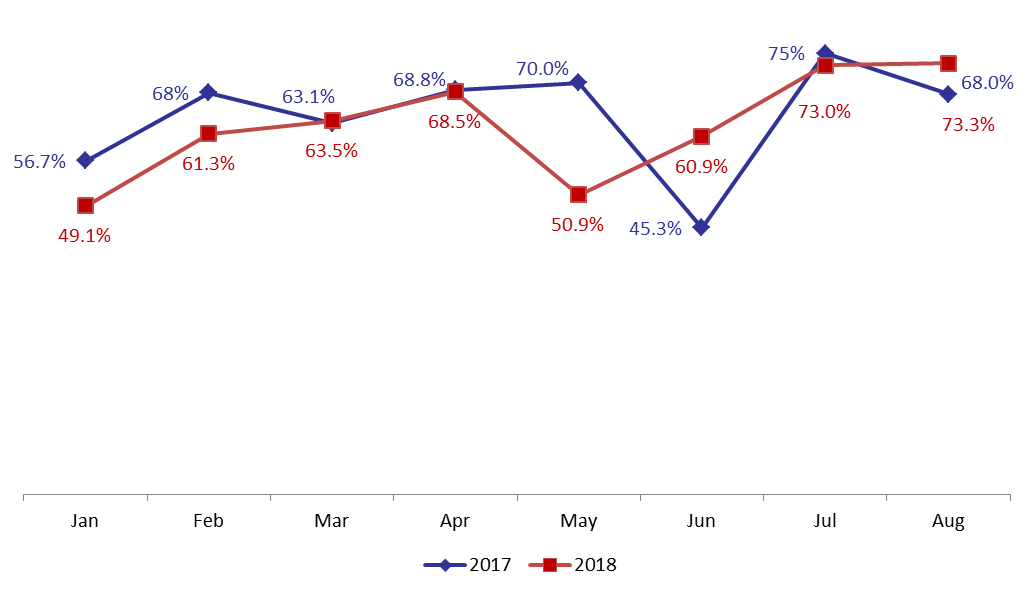

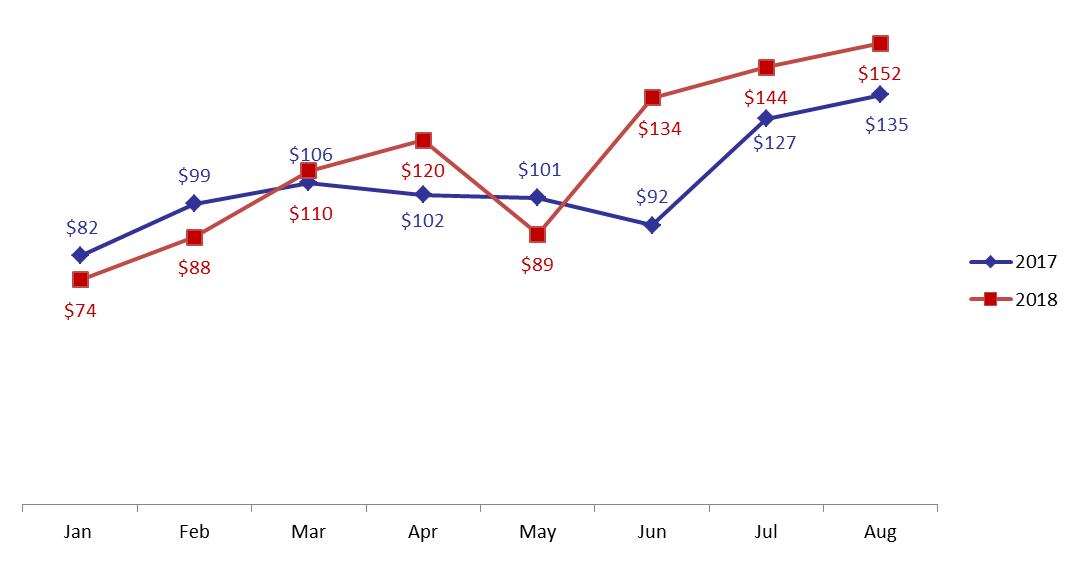

According to the latest report published by Ernst & Young, Beirut’s hotel occupancy rate fell to 62.6% in the first 8 months of 2018, compared to 64.3% registered during the same period last year. The average room rate (ARR) of Beirut’s 4 and 5 star hotels rose by a marginal 1.9% year-on-year (y-o-y) to $188. However the room’s yield (RevPAR) witnessed a yearly downtick by 0.8% to $118 by August 2018. The decrease in Lebanon’s Hotel occupancy rate since the beginning of the year can be linked to the yearly 5.24% decline in the number of Arab tourists by August 2018, knowing that Arabs are Lebanon’s largest spenders and are therefore the most likely to stay in 4- and 5- stars hotels.

The hospitality market in Cairo City, witnessed one of the best performances in the first 8 months of the year 2018 as occupancy rose by 6.3% percentage points (p.p) compared to the same period last year, coupled with annual increases in ARR and RevPAR by 8.5% and 19.2% to $104 and $73, respectively,. The growth in Cairo’s hospitality market can be attributed to the increasing stability on the political front and the government’s support to the tourism sector after Russia lifted a two-year suspension on flights to Egypt in April 2018.

Over the same period, Doha and Muscat recorded downturns across all Key Performance indicators (KPIs), whereby hotels’ occupancy rate decreased by 5.2 p.p. and 14.3 p.p.to 57,5% and 50.3%, respectively. In Doha, the downtick in the hotel’s occupancy rate can be attributed to the ongoing regional diplomatic crisis. As such, average room rate and rooms yield declined by 15% and 22.1%, to $127 and $73 by August 2018, respectively. Meanwhile in Muscat, the ARR and RevPar declined by 13.8% and 33% to $118 and $64, respectively. However, initiatives such as 10-day tourist visas for Indians is expected to improve the hospitality market in the upcoming months.

During the month of August alone, Beirut and Makkah recorded remarkable growths in all KPIs as Eid El Adha occurred by the end of August. In fact, Lebanon’s hotel occupancy rates rose by 5.3 p.p to 73.3% compared to August 2017 due to the increase in the number of Lebanese expacts wanting to spend the feast in Lebanpn . As such, Beirut’s ARR and RevPAR rose by 4.3% and 12.5% to $207 and $152, respectively. In Makkah , hotel occupancy rates rose by 15.7 p.p to 85% coupled with growth in ARR and RevPar by 40.9% and 72.6% to $375 and %318 respectively, due to the high demand to Hajj to the annual pilgrimage holy city.

Monthly Occupancy Rates in Beirut’s 4- and 5- star Hotels

Monthly Revenue per available Room (RevPAR) in Beirut’s 4- and 5- star Hotels

Monthly Revenue per available Room (RevPAR) in Beirut’s 4- and 5- star Hotels

Source: EY Middle East Hotel Benchmark Survey