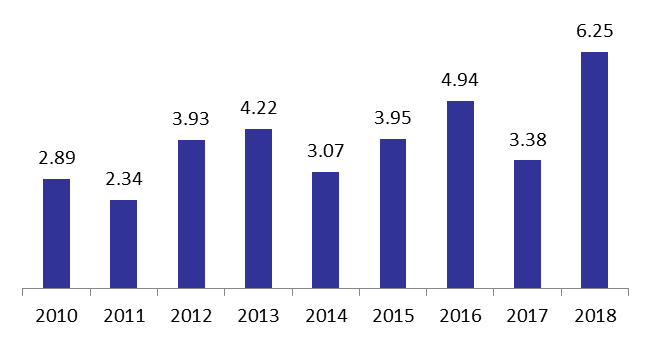

Lebanon’s fiscal deficit expanded from $3.75B by December 2017 to $6.25B (10.87% of GDP) by December 2018 the highest since 2010 according to the records of the Ministry of Finance. This was attributed to a 16.21% yearly increase in government expenditures to hit $16.36B (28.44% of GDP), while the fiscal revenues recorded a yearly downtick by 0.36% to stand at $10.74B (18.67% of GDP). The primary balance which excludes debt service posted a deficit of $635.64M, compared to a surplus of $1.43B by December 2017.

Tax revenues (constituting 78.85% of total revenues) increased by an annual 3.11% to $8.47B by December 2018. Revenues from VAT” (30.09% of total tax receipts) climbed by 10.51% y-o-y to $2.55B, and this can be largely attributed to the new VAT rate of 11%, increasing from 10% beginning January 2018. Meanwhile, “customs’ revenues” (15.9% of tax receipts) dropped by 6.38% year-on-year (y-o-y) to $1.34b. As for Non-tax revenues (21.1% of total revenues), they witnessed a drop of 11.46 % to stand at $2.27B by the end of 2018. This can be linked to the yearly decrease of 16.60% in “telecom revenues” (constituting 47.2% of total non-tax revenues) to reach $1.07B by December 2018.

On the expenditures’ side, total government spending increased by a yearly 16.21% to hit $16.36B by December 2018. In details, transfers to Electricity du Liban (EDL) alone rose by 32.26% to reach $1.76B which followed the 28.34% annual rise in average oil prices to $71.69/barrel over the period.

Moreover, total debt servicing (including the interest payments and principal repayment) reached $5.61B by December 2018, up by a yearly 8.30% such that interest payments alone rose by 8.44% y-o-y to $5.41B. Interest payments on domestic debt retreated by 1.88% y-o-y to $3.17B. In details, the total amount of local currency debt rose by 5.10% y-o-y to $51.64B by the end of 2018. Moreover, the swap agreement between the Mof and BDL consisted that the latter subscribed in LBP8, 250B of treasury bills at 1% coupon. The operation took place during 2018 in June, August, September and November.

Meanwhile, interest payments on foreign debt rose by an annual 27.36% to $2.24B noting that the total amount of foreign currency grew yearly by 10.23% to reach $33.49B in 2018. In fact the other part of the swap included the Central Bank buying $5.5B of Eurobonds from the Ministry of Finance. $2.5B of the total were used to pay maturing Eurobonds. Worth mentioning that some of the Eurobonds were issued at longer maturities and therefore bearing higher interest rates.

In its turn, the treasury transactions posted (includes revenues and spending that are of temporary nature) deficit of $624M, compared to $455.11M by December 2017[1]. In fact, treasury expenses of which municipalities climbed from $412.3M to $570.40M over the same period.

Yearly Fiscal Deficit by December (in $B)

Source: Ministry of finance

[1] Worth mentioning that in its new budget the Lebanese Government seeks to lower Lebanon’s fiscal deficit to 8% in 2019 without taking into consideration the treasury transactions deficit.