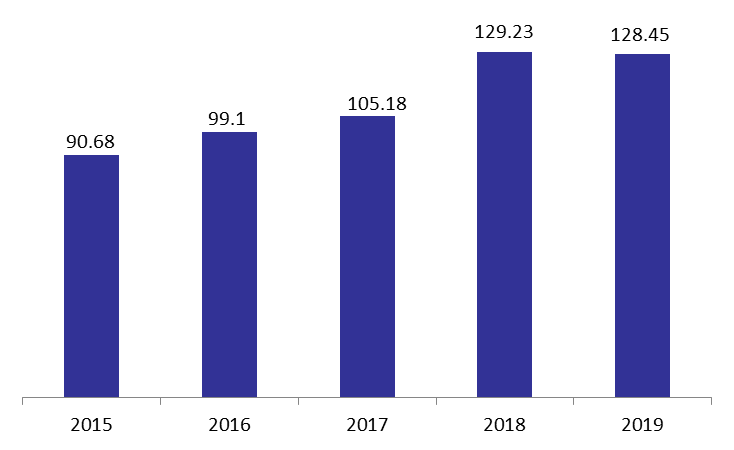

According to the central bank’s (BDL) balance sheet, total assets dropped by 8.64% year-to-date (YTD), to reach $128.45B in June 2019. In fact, the changes in the most accounts can be related to the Central Bank of Lebanon which carried out a netting operation between its “Loans to the local financial sector” and “Financial Sector Deposits”. According to BDL, this offsetting of loans with their corresponding deposits is in accordance with IFRS 7

In details, BDL’s Foreign assets (constituting 28.33% of total assets) declined by 8.25% since December 2018 to reach $36.39B, while the Securities portfolio (constituting 25.84% of total assets) recorded a 7.67% YTD uptick to settle at $33.20B over the same period. In their turn, Loans to the local financial sector (11.80% of total assets) witnessed a drop by 54.92% to $15.15B in June 2019. As for Gold assets (10.16% of total assets), they recorded an increase of 10.88% YTD, to stand at $13.05B.

On the liabilities side, Financial Sector Deposits (82.21% of BDL’s total liabilities) decreased by 11.84% YTD to reach $105.60B in June 2019. As for Public sector deposits, (3.38% of total liabilities), they declined by 13.68% YTD to $4.34B in June2019.

Yearly levels of BDL’s Total Assets in June ($B)

Source: BDL