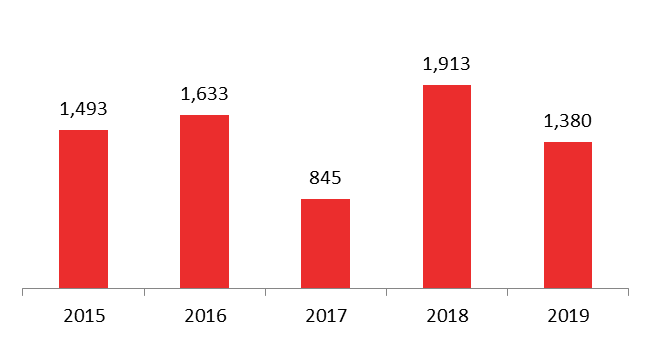

Lebanon’s fiscal deficit (cash basis) narrowed from $1.91B by April 2018 to $1.38B by April 2019. This was attributed to an 11.86% yearly drop in government expenditures to hit $4.54B. Meanwhile, fiscal revenues recorded a yearly decrease by 4.69% to stand at $3.29B. Worth mentioning that the primary balance which excludes debt service posted a surplus of $22.80M, compared to a deficit of $365.25M during the same period last year.

Tax revenues (constituting 82.73% of total revenues) declined by an annual 3.30% to $2.73B by April 2019. Revenues from VAT” (29.37% of total tax receipts) dropped by 16.98% y-o-y to $800.61M. In fact, although the new VAT rate of 11% was applied in beginning of January 2018 increasing from 10%, the decrease in the VAT revenues can be linked to the stagnating economy and recession in many sectors. In the car sector for example the VAT payment is done after the car registration. However, according to the Association of Lebanese Car Importers, the total number of newly registered commercial and passenger cars fell by 21.16 % year- on- year (y-o-y) to 8,601 cars by April 2019. Meanwhile, “customs’ revenues” (14.94% of tax receipts) dropped by 6.29% year-on-year (y-o-y) to $407.12M. As for Non-tax revenues (17.27% of total revenues), they witnessed a significant slump from 638.01M by April 2018 to $569.06M by April 2019. This can be linked to the yearly retreat by 14.25% in “telecom revenues” (constituting 38.02% of total non-tax revenues) to reach $216.33M by April 2019. In fact, the decrease in “telecom revenues” can be attributed first to the shift from traditional calls operated by Ogero and mobile companies to easier and cheaper ways such as WhatsApp Calls. Moreover, Ogero hired 453 people after a public sector hiring freeze introduced in August 2017.

On the expenditures’ side, total government spending declined by a yearly 11.86% to hit $4.54B by April 2019. In details, transfers to Electricity du Liban (EDL) alone slid by 2.88% to reach $506.71M which followed the 3.77% annual decline in average oil prices to $65.78/barrel over the period. Moreover, total debt servicing (including the interest payments and principal repayment) reached $1.40B by April 2019, down by a yearly 9.41% such that interest payments alone dropped by 9.52% y-o-y to $1.36B. Interest payments on domestic debt declined by 13.58% y-o-y to $941.29. This can be due to the swap operation in May 2018, in which the BDL subscribed to the equivalent of LBP 8,250B in T-bills, for maturities ranging between 3 and 10 years, with a coupon rate of 1%. Meanwhile, interest payments on foreign debt recorded year-on-year an uptick by 1.05% to $422.46M.

In its turn, the treasury transactions posted (includes revenues and spending that are of temporary nature) a deficit of $132.41M, compared to $216.82M by April 2018. In details, treasury expenses of which municipalities dropped from $368.779M to $70.58M over the same period noting that the government released overdue funding to municipalities in the following months.

Yearly Fiscal deficit by April (in $M)

Source: Ministry of finance