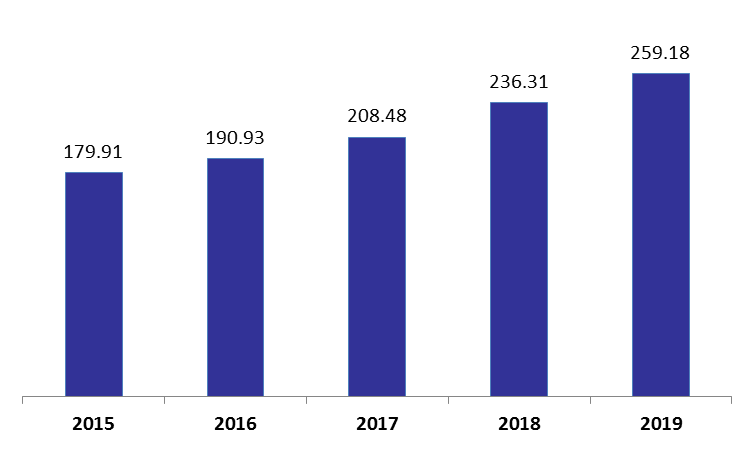

According to the commercial banks’ consolidated balance sheet, Total assets of the banks added 3.89% year-to-date (YTD) to $259.18B by July 2019. It is worthy to note that towards the end of July 2019, the central bank (BDL) launched an initiative to boost investors’ confidence in Lebanon, by which it offered commercial banks attractive rates on their fresh dollar deposits and loans in LBP at interest rates as low as 2%, that they will place with BDL at around 11%.

In details, banks’ Total private sector deposits increased by 1.12% YTD and 0.13% month-on-month to reach $172.35B by July 2019. The breakdown of deposits revealed Resident customers’ deposits (51.74% of total liabilities) decreased by a marginal 1%YTD to $134.1B by July 2019, with deposits in LBP sliding by 4.68%YTD to $44.3B while deposits in foreign currencies added 0.92%YTD to $89.8B. Meanwhile, Non-resident customers’ deposits (14.23% of total liabilities) also retreated by 2.26%YTD to $36.87B over the same period, owing it to a 7.86%YTD decline in LBP deposits to $3.97B and a 1.54% YTD retreat in foreign currencies to $32.9B by July 2019. As such, the dollarization ratio of Private sector deposits grew from 70.62% in December 2018 to 71.73% in July 2019.

On the liabilities side, banks’ Reserves (57.27% of total assets) recorded a 13.5% YTD uptick to settle at $148.4B by July 2019. The increase in reserves came on the back of a 13.52% YTD growth (and a 3.21% month-on-month growth) in deposits with the central bank (BDL) which reached $147.8B over the period. In turn, banks’ Total loans to the private sector retreated by 6.82% YTD to settle at $54.89B by July 2019. The breakdown of loans revealed that Claims on resident customers (18.67% of total assets) declined by 6.56% YTD to $48.4B by July 2019. As for the Resident Securities Portfolio (12.91% of total), it decreased by 4.91% YTD to stand at $33.46B. In fact, banks’ subscriptions to T-bills remained on the decline, with their stock of T-Bills slipping by 3.34% YTD to $16.8B as banks continued to shy away from non-attractive yields offered on government papers. In their turn, Banks’ holdings of Eurobonds also fell by 6.2% YTD to $15.04B over the same period.

Total Assets of Commercial Banks by July (in $B)

Source: BDL