Lebanon’s balance of payments (BOP) registered a surplus of $921.5M in August 2019, owing it to a foreign placement of $1.4B in BDL Certificates of Deposits (CDs). In fact, BDL’s NFAs witnessed an uptick of $1.59B in the month of August 2019 alone, while NFAs of commercial banks declined by $664.8M over the same period. A family office in France placed $1.4B in CDs issued by the central bank at a yield of 11%, in a deal managed by Société Générale de Banque au Liban (SGBL) & Goldman Sachs.

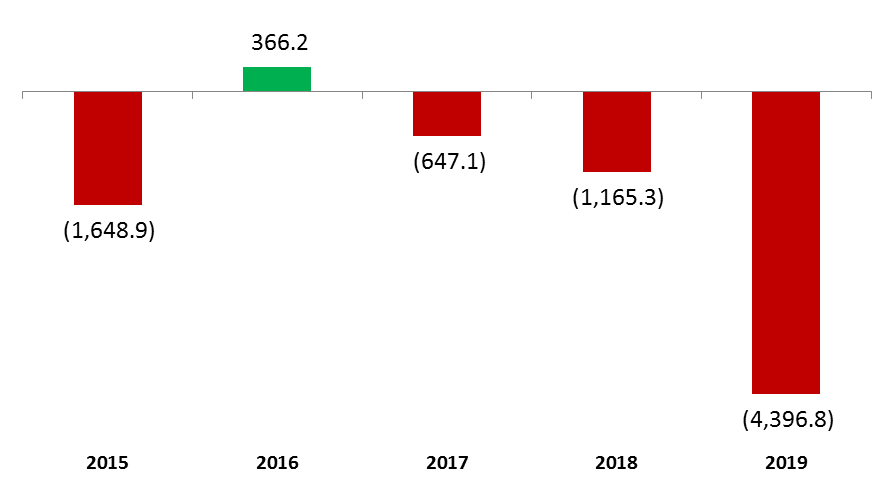

As for the first 8 months of the year, the BoP registered a deficit of $4.4B, down from July’s all-time high deficit which amounted to $5.32B. However, this year’s deficit remains high when compared to the $1.2B deficit recorded by August 2018. In details, the Net Foreign Assets (NFA) of BDL and commercial banks retreated by $1B and $3.4B by Aug 2019, respectively.

In fact, August 2019 witnessed the full materialization of the impact of BDL’s initiative in an attempt to boost investors’ confidence in Lebanon. By end-July, BDL aimed to re-incentivize Lebanese commercial banks to attract fresh dollars as deposits into the country. In return, it enabled banks to offer attractive yields close to 14% on their fresh USD deposits and offered them 2% loans in LBP in return for their dollars which will be placed at the central bank at a rate close to a rate of 10.5%.

Balance of Payments (BoP) by August (in $M)

Source: BDL