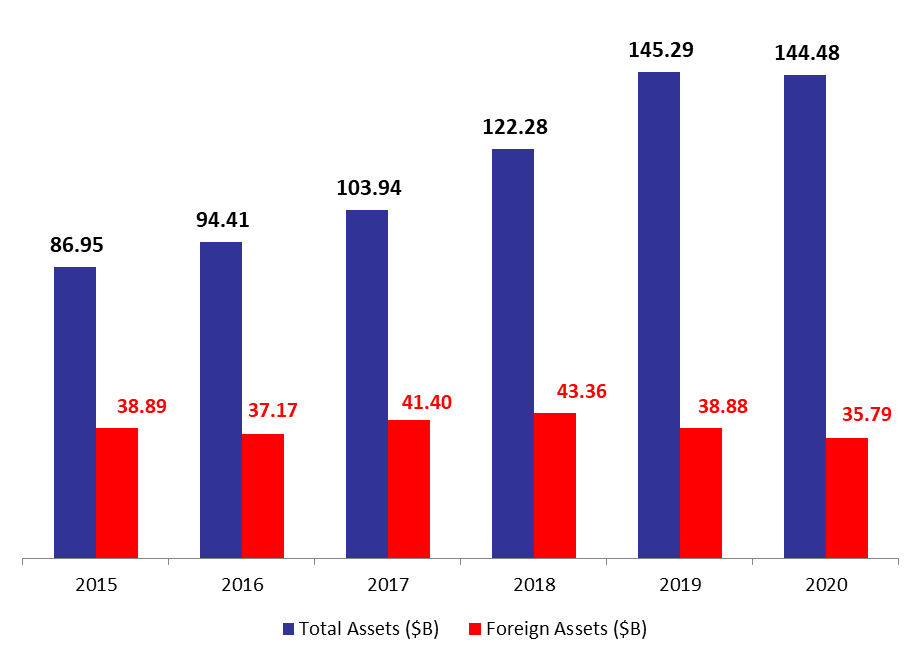

According to the central bank’s (BDL) balance sheet, total assets recorded an increase by 2.21% since year-start, to end the month of February 2020 at $144.48B.In details, BDL foreign assets account (constituting 24.77% of total assets) recorded a year to date decline by 3.98% ($1.48B) to reach $35.79B in Feb.2020.In fact, the Central Bank is using the foreign assets to cover the imports of essential goods, including fuel, wheat and medicine. Worth mentioning that on a monthly basis (end Jan to end Feb) the foreign assets retreated by $870M from which $200M related to the decrease in the Eurobonds held by the BDL to reach $5.5B in Feb.2020.

Meanwhile, BDL’s Securities portfolio (26.46% of total assets) added 0.64% year-to-date (YTD) to settle at $38.23B in Feb.2020. In their turn, Loans to the local financial sector (10.27% of total assets) witnessed a decrease by 0.67% to $14.84B in Feb.2020. As for Gold assets (10.39% of total assets), they recorded an increase of 7.69% YTD, to stand at $15B. In details, Gold prices rose by 4.46% since the start of the year to $1,584/ounce by the end of Feb, 2020.

On the liabilities side, Financial Sector Deposits (77.96% of BDL’s total liabilities) lost 0.56% YTD to settle at $112.64B in Feb. 2020, while Public sector deposits (3.32% of total liabilities) decreased by 11.91% YTD to stand at $4.79B over the same period as the government was withdrawing these deposits to cover its budget deficit. Worth mentioning that Currency in Circulation Outside BDL (5.99% of BDL’s total liabilities) rose by 23.55% YTD to stand at $8.66B in Feb 2020. In fact, the increase in Currency in circulation and in Demand deposits in LBP is due to the financial instability and to Lebanese preferring to keep cash money.

Total and Foreign Assets at BDL in Feb ($B)

Source: BDL