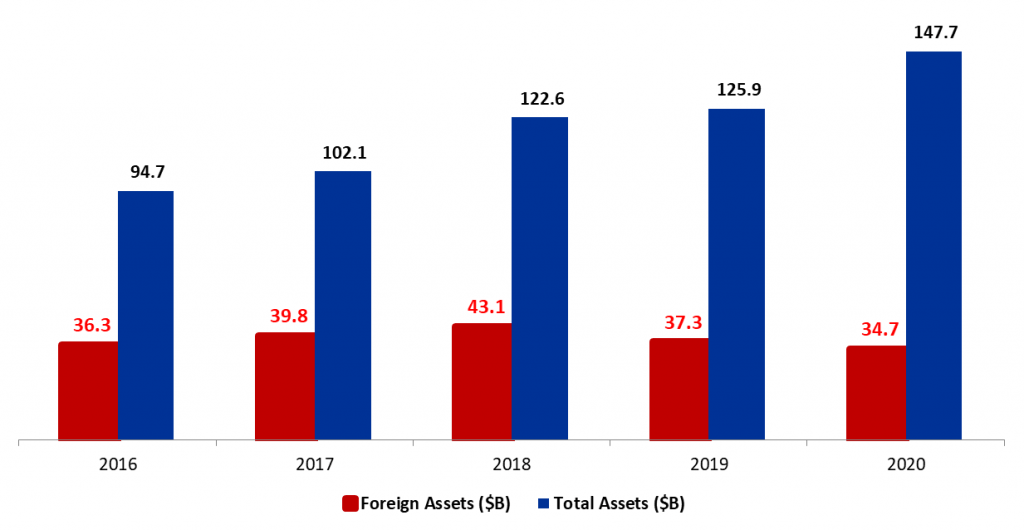

According to the central bank’s (BDL) balance sheet, Total assets increased by 4.5% year-to-date (YTD) to reach $147.7B in mid-April 2020. The breakdown of the balance sheet links this uptick to a notable 13.1% rise in gold prices to reach $1,715/ounce by mid-April. As such, BDL’s Gold assets (10.7% of total assets) grew by 13.3% YTD to stand at $15.8B.

In turn, BDL’s Securities portfolio (26% of total assets) registered an uptick of 1.1% since year-start to $38.4B in mid-April 2020. However, the balance sheet further reveals that BDL’s Foreign assets (23.5% of total assets) retreated by $2.6B (or 6.9%YTD) to stand at $34.7B over the same period. This continues to be attributed to BDL covering the costs of importing essential goods from its foreign assets with capital controls still in place, noting the country also announced its default on March 07th 2020, on all foreign currency due payments. Meanwhile, Loans to the local financial sector (9.9% of total assets) slipped by 1.2% to $14.7B.

On the liabilities side, Financial Sector Deposits (76.2% of total BDL liabilities) climbed by a marginal 0.46%YTD totaling $112.5B by mid-April 2020. Meanwhile, Public sector deposits (3.3% of total liabilities) contracted by 9.4% since year-start to $4.9B over the same period as the government withdrew from these deposits to cover the budget deficit as budget revenues continue to narrow amid the country’s ongoing economic crisis coupled with Covid-19’s economic toll. In addition, amid the crisis, citizens’ preference of cash money continued to grow as reflected in the Currency in Circulation outside BDL (6.8% of total liabilities) which went from $7B by end-December 2019 to $10.05B by mid-April 2020.

BDL Total and Foreign Assets in Mid-April

Source: BDL