In a regional analysis of the hospitality sector performance presented by Ernst & Young’s Middle East (ME) Hotel Benchmark Survey, key performance indicators (KPIs) of Arab capitals hit unprecedented lows as all nations imposed nationwide curfews, lockdowns and, or travel bans.

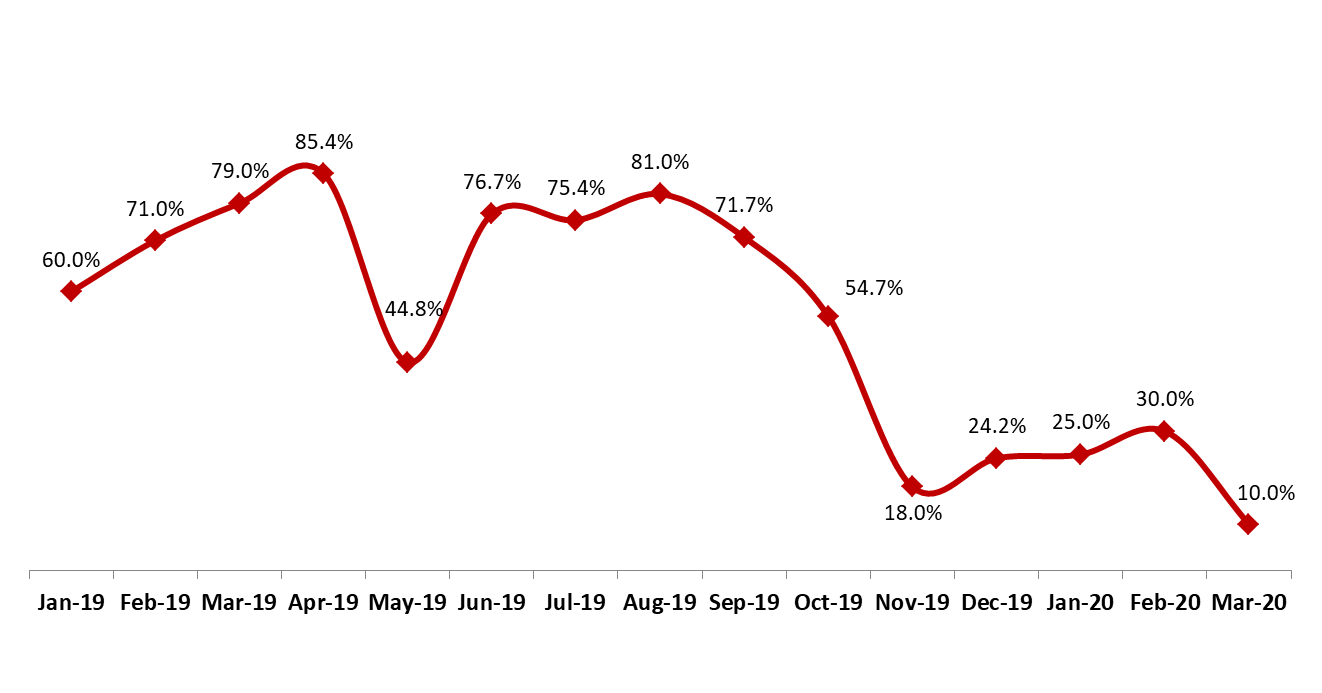

Among the most eminent capitals in the ME, the occupancy at Beirut’s 4-and 5-star hotels suffered the most as it fell to an unprecedented low of 22% in Q12020, down by 48.1 percentage points (pp) during the same period last year. The slump is grave with the ongoing economic crisis, street protests and coronavirus measures in place, especially noting that Lebanon’s tourism sector (&related services) constitutes one of the main growth drivers for the economy. Correspondingly, the Average Room Rate and Rooms Yield declined from $189 and $132 in Q1 2019 to $130 and $28, respectively, in Q1 2020.

The other ME nations whose hospitality markets were notably hit included: Manama, Dubai, Cairo and Muscat.

In detail, the occupancy rates in Manama fell by 13.9 pp to 43% in Q1 2020 while the Average room rate and Rooms yield slumped from $161 and $91 to $139 and $59, respectively. Cairo city also witnessed decreases in KPIs across the board as the occupancy fell by 16.7pp to 62% in Q1 2020 while Average room rate and Rooms yield slumped by 10.5pp and 29.5pp to settle at $107 and $66, respectively, over the same period.

When compared to Q1 2019, Dubai’s hospitality market overall witnessed slumps across the KPIs . In fact, the occupancy rate lost 21.3pp to stand at 65% in Q1 2020. Average room rates and Rooms revenue followed suit, slipping by 13.7pp and 35pp year-to-date (YTD) to $234 and $152, respectively. Like all ME cities, the hospitality sector in Dubai was not immune to the travel restrictions, events suspension and closure of main tourist attractions imposed in response to COVID-19. However, the Dubai government has announced an AED 1.5B economic stimulus package, to cushion the potential impacts of the COVID-19 outbreak which may include initiatives focused on supporting the tourism sector, among others.

In Muscat, KPIs dropped across the board. The city’s hotel occupancy rates decreased by a YTD 19.7 pp to 52% in Q1 2020. Accordingly, the Average room rate and Rooms yield fell by 10.5 pp and 35.0 pp to lows of $135 and $71, respectively, over the same period. Muscat’s hospitality market had global entertainment events planned such as the 2020 GC Racing Tour and the Oman Petroleum-and-Energy Show. However, those events were cancelled as the pandemic erupted. Such cancellations, alongside suspension of visa tourists and coronavirus measures took their toll on the hospitality KPIs as presented above.

For Beirut, the downward trend of the hospitality KPIs since October 2019 signal a long recovery period especially as the country struggles to “stabilize” the economy. Meanwhile, the tourism sector recovery is expected to be less prolonged in the neighboring nations who will benefit from the planned gradual easing of coronavirus restrictions. These may help reinvigorate hospitality and tourism on the medium-to-long term in the ME.

Monthly Occupancy Rates in Beirut’s 4-&5-Star Hotels

Source: BLOMInvest Bank; E&Y Middle East Hotel Benchmark Survey