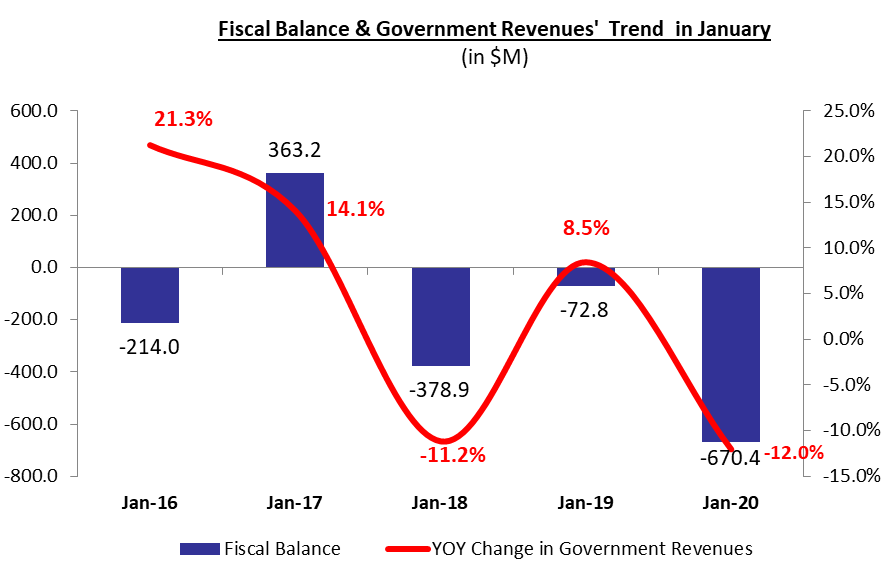

The cash-basis fiscal deficit of Lebanon climbed to a 10-year high of $670.4M in Jan. 2020, after registering a $72.83M deficit in the same period last year. In fact, the national developments since October 2019 mainly entailed street protests, the disruption of operations in the public and private sectors, in addition to Lebanon announcing its default on all foreign payments in March 2020.

Consequently, revenues dropped severely while expenses were magnified. In detail, the substantial deficit is attributed to the annual 10.77% drop in government revenues (including treasuries) which fell to $1.02B in Jan. 2020. On the counterpart, total expenditures (including treasuries) added a yearly 39% to $1.7B in the first month of the year. It followed that the primary balance (which excludes debt service) registered a sizeable deficit of $326.4M over the same period, compared to $231.7M in surplus in Jan. last year.

The breakdown of the government’s fiscal performance in 2020 revealed that Tax revenues (composing 84.8% of budget revenues) fell by 10.5% year-on-year (YOY) to $807.8M in Jan. 2020, of which VAT revenues (26.9% of total tax receipts) declined by 28.9%YOY to $216.9M. By the same token, revenues from the Lebanese Customs (8.2% of total tax receipts) decreased by an annual 37.8% to $66.2M in Jan.2020.

In their turn, Non-tax revenues (15.1% of total revenues) slumped by 20%YOY to $144M in Jan. 2020, largely due to the 20.2%YOY decrease in Telecom revenues (46% of Non-tax revenues) to $66.3M over the same period.

Meanwhile, the expenditures recorded remarkable increases, with Total government spending increasing by an annual 45% to $1.6B in Jan. 2020. In detail, Transfers to Electricite du Liban (grasping 12% of total public expenditures) rose from last year’s $65.8M to $189.9M in Jan. 2020, partly as a result of the international average price of oil climbing by an annual 5.7% to $63.67/barrel in Jan. 2020.

Moreover, Total debt-servicing (inclusive of interest payments and principal repayments) stood at $172M in January 2020, up from $152.3M in the same period last year. In fact, interest payments on domestic debt composed a large chunk (or 84.7%) of total interest payments and added 16%YOY to $285M. This goes hand-in-hand with the substantial 12.3% increase registered in the total debt denominated in Lebanese pounds which hit $58B over the same period. Meanwhile, interest payments on debt denominated in foreign currency slipped by 1.5%YOY to $41.2M, noting that gross public debt in foreign currency rose by 0.9%YOY to $33.9B in January 2020, of which $31.3B are the total outstanding Eurobonds.

Lastly, Treasury transactions inclusive of revenues and expenditures that are of a temporary nature, posted a deficit of $25M in Jan.2020, down by an annual 50%.

Source: Ministry of Finance