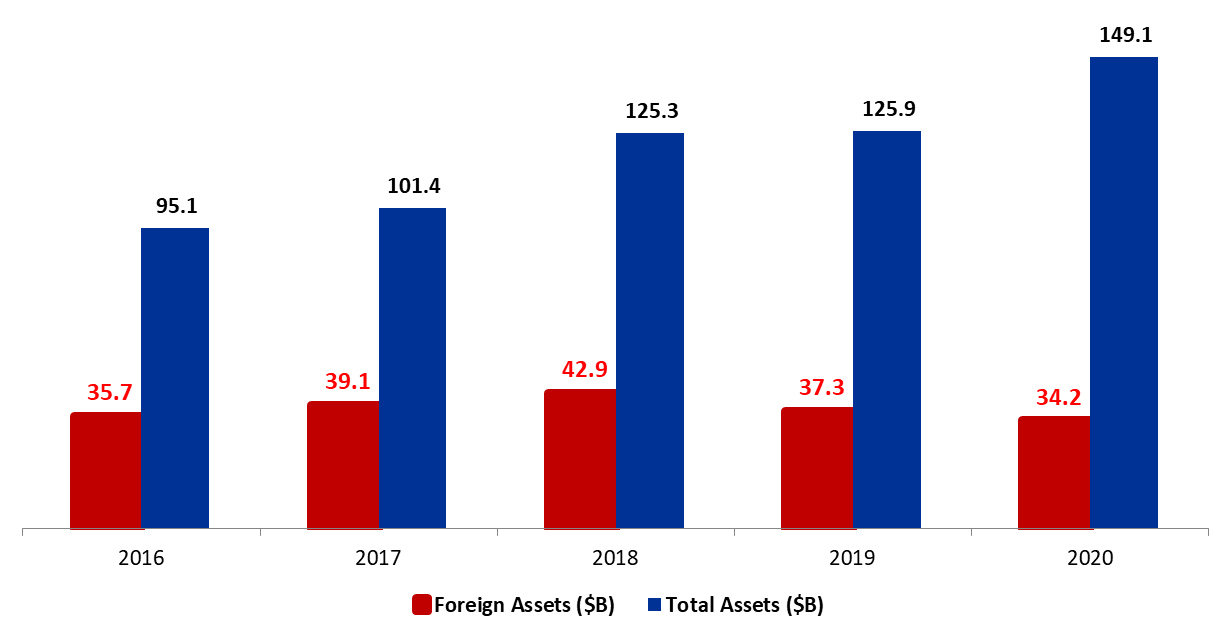

According to the central bank’s (BDL) balance sheet, total assets rose by 5.48% since year-start, to stand at $149.10B in mid-May 2020. In fact, this can be mainly attributed to the rise in “Gold” account (10.52% of total asset) by 12.55% to reach $15.68B in Mid-May 2020.

BDL foreign assets (constituting 22.95% of total assets) recorded a year to date decline by 8.18% ($3B) to reach $34.22B in Mid-May 2020. Worth mentioning that since the end of April till mid-May, foreign assets retreated by $200M.This continues to be attributed to BDL covering the costs of importing essential goods from its foreign assets

Meanwhile, BDL’s Securities portfolio (25.83%of total assets) added 1.39% year-to-date (YTD) to settle at $38.52B in mid-May 2020. Moreover, BDL’s Other Assets (22.59%of total assets) rose by 34.92% YTD to reach $33.67B in mid- May 2020.In their turn, Loans to the local financial sector in LBP (9.89% of total assets) witnessed a downtick by 1.34% to $14.74B in mid-May 2020

On the liabilities side, Financial Sector Deposits (75.45% of BDL’s total liabilities) rose by 0.43% YTD to settle at $112.50B in mid-May 2020, while Public sector deposits (3.09% of total liabilities) decreased by 15.35% YTD to stand at $4.60B over the same period, as the government was withdrawing these deposits to cover its budget deficit. Worth mentioning that Currency in Circulation outside BDL (7.49% of BDL’s total liabilities) rose by 59.43% YTD to stand at $11.17B in mid-May 2020. In fact, the increase in Currency in circulation is due to the BDL increase in money supply, following a series of circulars allowing depositors with foreign currency accounts to withdraw cash in Lebanese lira at market rate.

BDL Foreign and Total Assets in mid-May

Source:BDL