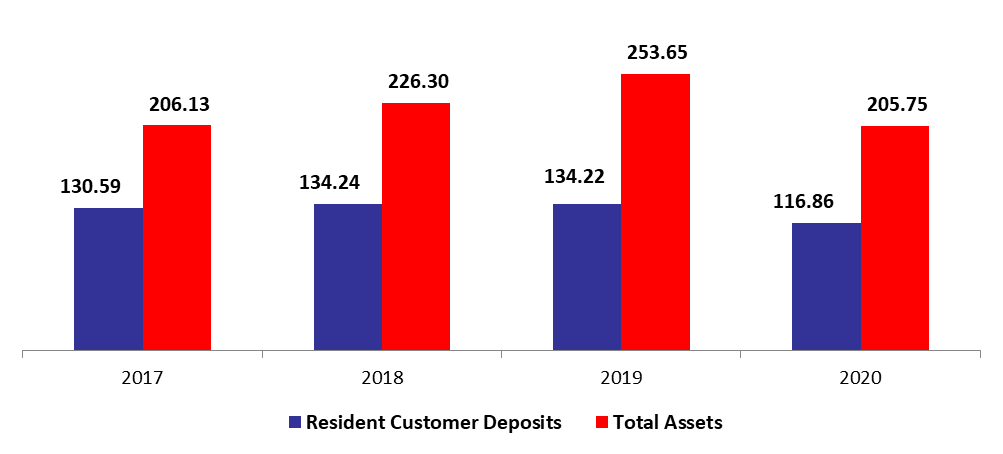

According to Lebanon’s consolidated commercial banks’ balance sheet, total assets decreased by 5.09%, year-to-date (y-t-d), to stand at $205.75B in April 2020.

In details, Resident customers’ deposits (which grasp 56.80% of total liabilities) decreased since the start of the year by 6.53% ($8.17B) to $116.86B in April 2020, with deposits in LBP and in foreign currencies declining by 18.85% and 1.84% to $27.97B and $88.88B, respectively. As for the Non-resident customers’ deposits (14.17% of total liabilities), they retreated by 10.12% ($3.28B) and totaled $29.16B over the same period on the back of a drop in deposits in LBP and in foreign currencies by 20.56% and 9.01% to $2.49B and $26.67B, respectively. As such, the dollarization ratio for private sector deposits increased from 76.02% in December 2019 to 78.94% in April 2020.

On the assets side, Reserves (constituting 57.08% of total assets) recorded y-t-d a downtick of 0.66% to settle at $117.44B in April 2020. Deposits with the central bank (BDL) (99.36% of total reserves) recorded a monthly downtick of 0.88% to reach $116.68B. Worth mentioning that starting December 2019 (and according to the offsetting criteria in IAS 32 “Financial Instruments: Presentation”), banks have offset their loans taken from BDL in LBP with their corresponding placements at BDL in LBP carrying the same maturities. Meanwhile, on Claims on resident customers (18.62% of total assets) retreated by 12.77%, to stand at $38.30B in April 2020. Moreover, Claims on the government (12.65% of total assets), they declined by 13.06% during the year to stand at $26.13B. In details, the subscription to T-bills in LBP and to Eurobonds recorded a decline by 4.53% and 23.09% to $13.97B and $10.62B, respectively in April. 2020.As for the Claims on non- resident customers, they dropped yearly by 4.78% to reach $5.30B in April 2020. However, it is worthy to mention, that on monthly basis this account recorded an increase for the first time since September 2019. In details, it rose monthly by $286M.

Commercial Banks Assets and Residents Customer Deposits in April ($B)

Source: BDL