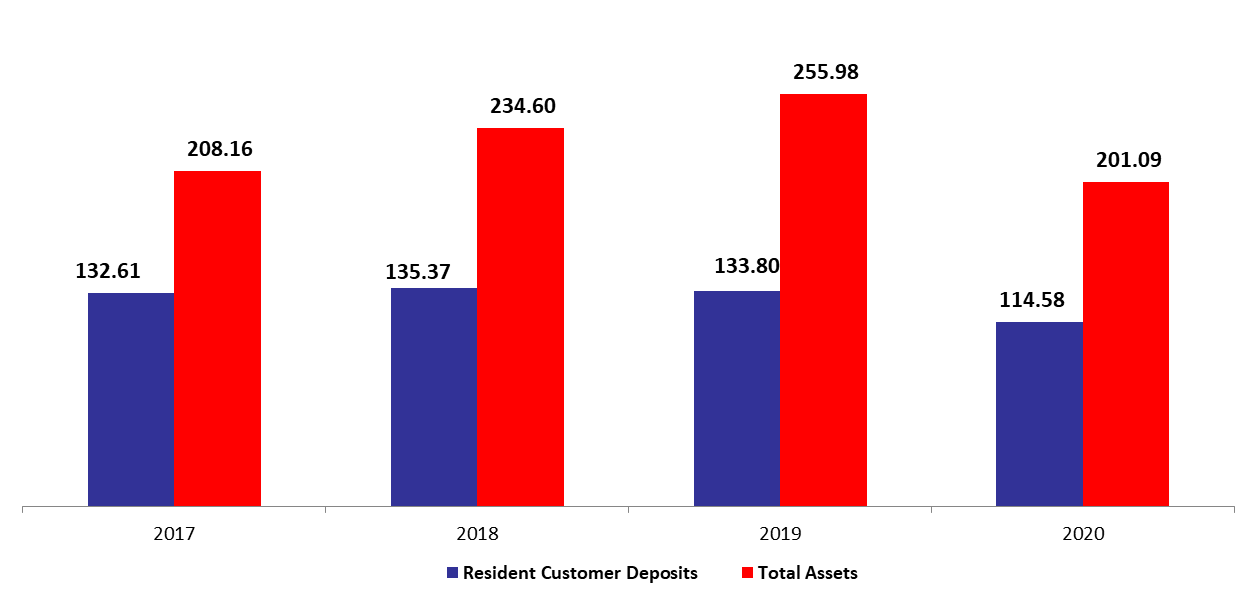

According to Lebanon’s consolidated commercial banks’ balance sheet, total assets decreased by 7.24%, year-to-date (y-t-d), to stand at $201B in June 2020.

In details, Resident customers’ deposits (which grasp 56.98% of total liabilities) decreased since the start of the year by 8.36% ($10.45B) to $114.58B in June 2020, with deposits in LBP and in foreign currencies declining by 23.96% and 2.41% to $26.21B and $88.36B, respectively. As for the Non-resident customers’ deposits (14.09% of total liabilities), they retreated by 12.70% ($4.12B) and totaled $28.33B over the same period on the back of a drop in deposits in LBP and in foreign currencies by 26.70% and 11.20% to $2.30B and $26B, respectively. As such, the dollarization ratio for private sector deposits increased from 76.02% in December 2019 to 79.83% in June 2020.

On the assets side, Reserves (constituting 57.85% of total assets) recorded y-t-d downtick of 1.60% to settle at $116.32B in June 2020. Deposits with the central bank (BDL) (97.17% of total reserves) recorded a y-t-d downtick of 2% to reach $115.35B. Worth mentioning that starting December 2019 (and according to the offsetting criteria in IAS 32 “Financial Instruments: Presentation”), banks have offset their loans taken from BDL in LBP with their corresponding placements at BDL in LBP carrying the same maturities. Meanwhile, Claims on resident customers (18.05% of total assets) retreated by 17.33%, to stand at $36.30B in June 2020. Moreover, Claims on the government (12.76% of total assets) declined by 14.63% during the year to stand at $25.66B. In details, the subscription to T-bills in LBP and to Eurobonds recorded a decline by 6% and 24.86% to $13.76B and $10.38B, respectively in June 2020.

Commercial Banks Assets and Residents Customer Deposits in June ($B)  Source: BDL

Source: BDL