In the midst of the country’s ongoing political and economic crisis and the intensifying depreciation of the Lebanese Pound’s value on the parallel market, Lebanon’s inflation rate in July 2020 stood at 112.4%, the highest monthly rate since the Central Administration of Statistics (CAS) began releasing this series in December 2008..

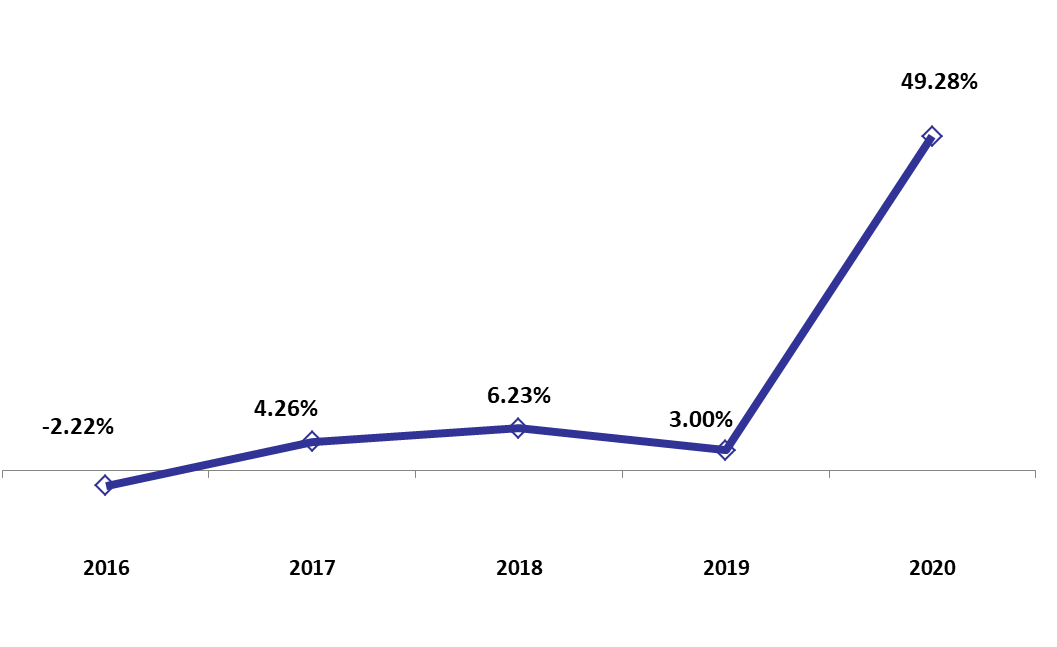

Looking at inflation in the 7 months of 2020, the rate stood at 49.22% compared to 3% by July 2019. In details, the average Consumer Price Index (CPI) surged from 108.74 points during the first 7 months of 2019 to an average of 162.32 points in the same period of 2020

As a result, all the sub-components of Lebanon’s consumer price index (CPI) increased over the studied period. For instance, the average costs of “Housing and utilities”, inclusive of water, electricity, gas and other fuels (grasping 28.4% of the CPI) added a yearly 2.92% by July 2020, as “Owner-occupied” rental costs (13.6% of Housing and utilities) rose yearly by 4.40% while the average prices of “water, electricity, gas, and other fuels” (11.8% of Housing & utilities) increased by 0.63% YOY.

Moreover, average prices of “Food and non-alcoholic beverages” (20% of CPI) soared by 140.35% by July 2020. Food overall has become more expensive mainly due to the collapsing currency, the dollar shortage in the market and the absence of proper monitoring by authorities on the market players’ pricing and profit margins.

Similarly, the average prices of “Transportation” (13.1% of the CPI), “Health” (7.7% of the CPI) and “Education” (6.6% of CPI) increased across the board, by annual rates 43.33%, 5.37% and 4.11%, respectively, over the period.

Remarkably, the average costs of “Clothing and Footwear” (5.2% of CPI) surged yearly by a substantial 170.27% by July 2020. Likewise, average prices of “Furnishings and household equipment” (3.8% of CPI) and “Alcoholic beverages and tobacco” (1.4% of CPI) increased by 181.04% and 175.77%, respectively, by July 2020.

It is worthy to note that the inflation rate is expected to rise further in the upcoming months if the central bank decides to stop covering the import of essential goods at the official exchange rate. In details, Governor Riad Salameh stated that he’s in the process of finding new ways to support trade because the central Bank cannot use the reserve requirements of banks to finance trade.

Average inflation Rate by July