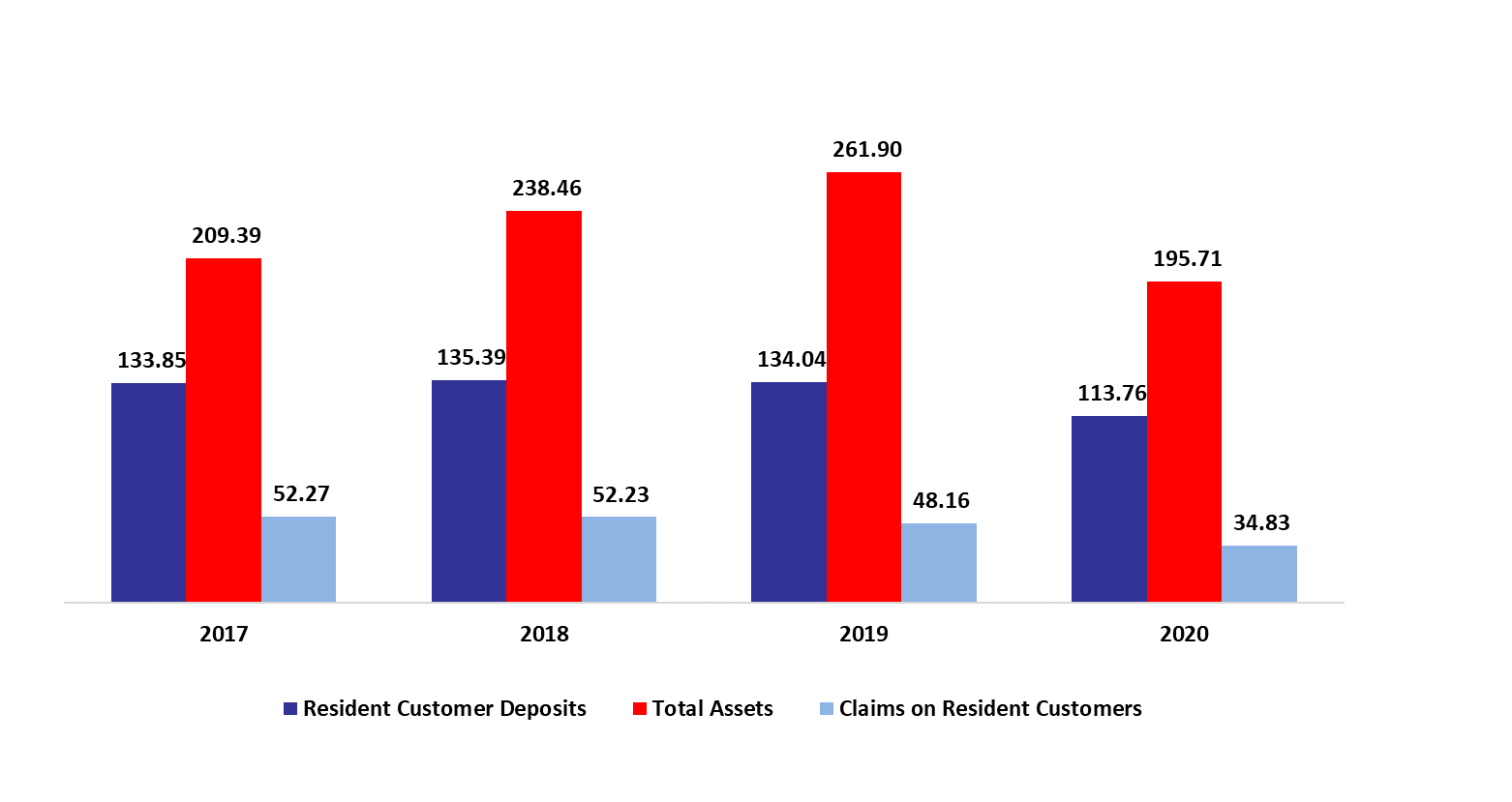

According to Lebanon’s consolidated commercial banks’ balance sheet, total assets decreased by 9.72%, year-to-date (y-t-d), to stand at $195.7B in August 2020.

In details, Resident customers’ deposits (which grasp 58.13% of total liabilities) decreased since the start of the year by 9.01% ($11.26B) to $113.76B in August 2020, with deposits in LBP and in foreign currencies declining by 25.90% and 2.58% to $25.55B and $88.22B, respectively. As for the Non-resident customers’ deposits (14.18% of total liabilities), they retreated by 14.47% ($4.69B) and totaled $27.75B over the same period on the back of a drop in deposits in LBP and in foreign currencies by 29.13% and 12.90% to $2.23B and $25.5B, respectively. As such, the dollarization ratio for private sector deposits increased from 76.02% in December 2019 to 80.18% in August 2020.

On the assets side, Reserves (constituting 58.09% of total assets) recorded y-t-d downtick of 3.82% to settle at $113.69B in August 2020. Deposits with the central bank (BDL) (99.02% of total reserves) recorded a y-t-d downtick of 4.37% to reach $112.58B. Worth mentioning that starting December 2019 (and according to the offsetting criteria in IAS 32 “Financial Instruments: Presentation”), banks have offset their loans taken from BDL in LBP with their corresponding placements at BDL in LBP carrying the same maturities. Meanwhile, Claims on resident customers (17.80% of total assets) retreated by 20.69%, to stand at $34.83B in August 2020. Moreover, Resident Securities portfolio (12.58% of total assets) declined by 18.08% during the year to stand at $24.62B. In details, the subscription to T-bills in LBP and to Eurobonds recorded a decline by 11.36% and 26.94% to $12.98B and $10B, respectively in August 2020. Moreover, we can note that claims on non-resident financial sector dropped by 35.2% since the start of the year to record $4.39B in August 2020.

Commercial Banks Assets, Resident Customer Deposits and Claims on Resident Customers in August ($B)

Source: BDL

Source: BDL