On October 9 2020, Bank Audi announced that it has applied for the cancellation of the listing of its global depository receipts (GDR) from the official list of the UK financial conduct authority and the cancellation of the admission to trading its shares GDRS from London Stock Exchange with effect form 16 November 2020. However Audi GDRs will continue to be listed and traded on the Beirut Stock Exchange.

The reason for cancellation as per Bank Audi is due to low volume of GDRs traded on the London Stock Exchange and the high administrative costs of maintaining the listing of the GDRs at the London Stock Exchange. This cancellation of GDRs for Lebanese Banks is not the first, as Byblos bank has already announced of the cancellation of his GDR at London Stock Exchange for the same reasons in July 2020.

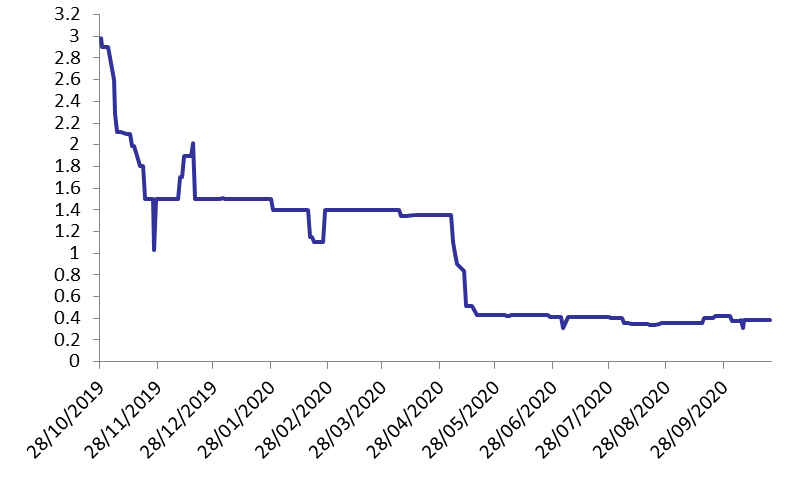

It’s worth mentioning that Bank Audi GDRs has dropped yearly by 87.25% to reach 0.38$ in 23 October 2020 compared to the same period last year. In fact, Lebanese banks are suffering after the financial crisis that hit Lebanon in October 2019. Further, Lebanese banks are supposed to raise their capital by 20% by the end of February 2021 or risk exiting the market, as per Riad Salameh, Governor of Central Bank (BDL).In this respect Bank Audi’s decision to cancel its GDRs trading on London Stock Exchange, is consistent with its goal to minimize the unnecessary cost outside Lebanon in order to meet the challenge of raising their capital before February 2021.

Bank Audi published its unaudited consolidated financial results Bank, for H1 2020. The bank said that additional provisions were allocated to cover for expected losses on corporate and Lebanese Sovereign exposures, thus exerting further pressure on earnings. In addition, total net profits fell from $250.36 M in H2 2019 to nil or zero in H1 2020. As to the balance sheet items, they changed as follows from end 2019 to H1 2020: assets fell by 1.96% to $15.07B; deposits decreased by 10.61% to $26.45B; loans declined by 16.55% to $8.64B; and shareholders’ equity increased by 4.03% to $3.09B.

Bank Audi S.A.L

| Billion $ | June 2020 | Dec 2019 | Change |

| Assets | 15.07 | 15.37 | -1.96% |

| Deposit | 26.45 | 29.59 | -10.61% |

| Loans | 8.64 | 10.35 | -16.55% |

| Shareholders’ equity | 3.09 | 2.97 | 4.03% |

| Net profit | 0 | 0.25 | -100% |

Audi Bank GDR share prices on LSE

Source: Bloomberg