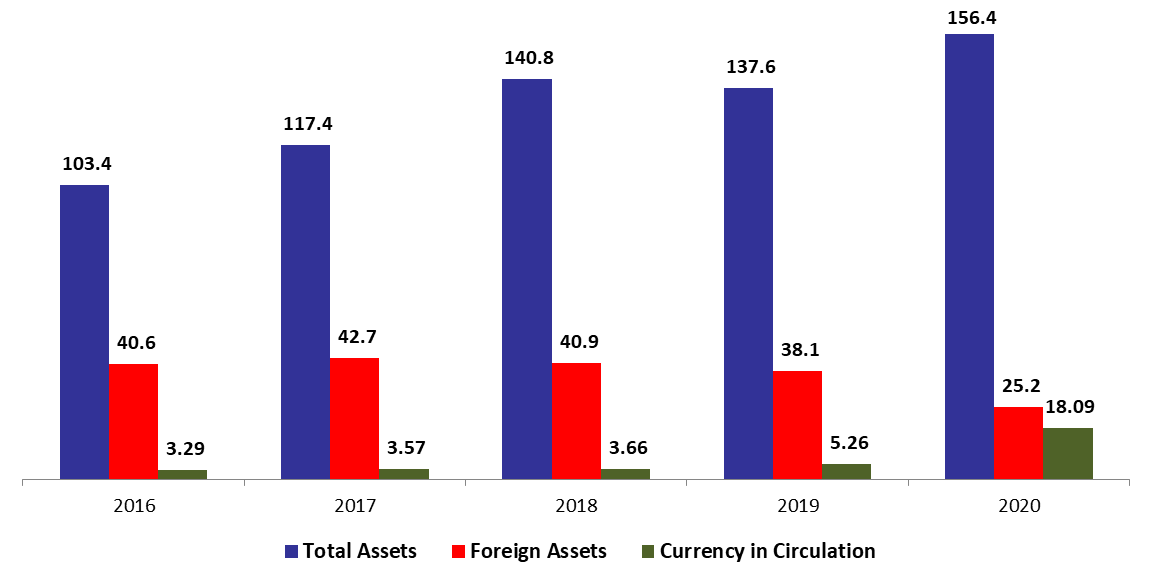

According to the balance sheet of Banque du Liban (BDL), the central bank’s Total assets added 10.64% since year-start, to reach $156.39B in Mid-November 2020. The increase was mainly due to the 24.46% rise in gold prices since the start of the year to $1,888/ounce by Mid-November 2020. As a result the “Gold” account (composing 11.09% of BDL’s total assets) increased by 24.41% to $17.34B. In addition, “Other assets” (grasping 30.11% of BDL’s total assets) rose by 88.64% since year to date, to reach $47B. In fact, this account has raised doubts about the accuracy of BDL financial position, since its components are not well known and whether they constitute loss or profit.

BDL’s foreign assets (grasping 16.15% of total assets) decreased by 32.25% ($12B) year to date (YTD) to stand at $25.25B by Mid-November 2020. In details, this account includes mainly Eurobonds held by BDL ($5B), loans to commercial banks estimated at $6B and mostly banks’ required reserves. It is worth noting that the decline in BDL’s Foreign assets on a monthly basis is mostly attributed to the continued subsidization of essential imports (including basic food, medicines and fuel) in addition to paying back loans and/or deposits in foreign currency, leaving the central bank with less facilities to finance trade of basic commodities. And this burden is bound to increase given the absence of capital inflows that might shore up BDL’s foreign assets. As a result, there is serious talk now of limiting BDL subsidies to very essential goods only.

On the liabilities front, Financial sector deposits (68.84% of BDL’s total liabilities) recorded a downtick of 3.89% YTD to settle at $107.66B in Mid-November 2020. Notably, Currency in Circulation outside of BDL (11.57% of BDL’s total liabilities) rose from $7B end-December 2019 to $18B in Mid-November 2020. This uptrend in circulated currency has been ongoing since the beginning of the year, as it continues to reflect clients’ strong preference for cash amid the growing uncertainty and feeble trust in the economy. In addition, BDL’s circulars No.148 and 151 further supported and facilitated cash withdrawals, as the circulars allowed depositors with foreign currency accounts to withdraw their savings in Lebanese lira at close to the market rate. Worth mentioning that BDL’s Governor Riad Salameh announced last week that Lebanon plans to introduce a digital currency next year to restore confidence in the banking sector and transition into a cashless system

Lebanon’s caretaker Finance Minister Ghazi Wazni announced last week a three-month extension of a deadline to provide all data required for a forensic audit of the Central Bank after it declined to submit some information, citing bank secrecy laws. The caretaker prime minister and sources familiar with the matter have said that Banque du Liban had withheld information needed by the consulting firm Alvarez & Marsal to begin the audit, which is a key demand for foreign financial assistance to help Lebanon tackle a financial meltdown.

BDL Total, foreign assets and currency in circulation in Mid-November ($B)

Source: BDL, BlomInvest Bank