Ernst & Young Middle East hotel benchmark survey informs that in September 2020, hospitality markets in the MENA region witnessed a drop when compared to the same period last year as a result of challenges imposed by COVID-19 pandemic and restrictions on social gatherings.

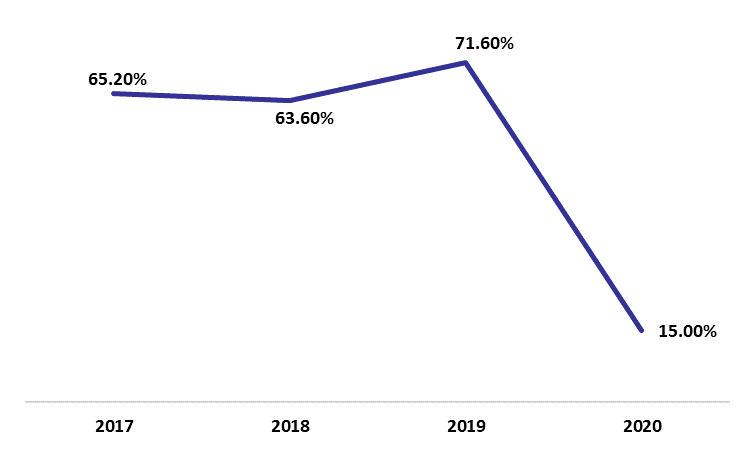

In details, the occupancy rate in Beirut city fell by 57.2% year-to-Date (YTD) to reach 15% by September 2020 in line with the drastic decrease in the average room rate and rooms yield which dropped from $199 and $143 to $159 and $23 by September 2020. The hospitality activity in Beirut deteriorated compared to Q3 2019 as a result of the ongoing economic crisis and currency devaluation; as such average inflation in October 2020 stood at 73.2% compared to 2.47% in October 2019. Upsurges in COVID-19 cases have also added to the weakened performance of the overall Beirut hospitality sector. Moreover, further reductions in the number of airport passengers in Beirut airport damaged the hospitality sector. In details, total number of airport passengers dropped yearly by 74.57% to reach 1.79M passenger by September 2020. It worth noting that despite the current political and economic crisis, one advantage of the depreciation of the Lebanese Lira on the unofficial market is the upswing in the local tourism in the medium term. In fact, the depreciation of a local currency means that travel, accommodation and a range of related expenses become more affordable for international tourists.

In its turn, Cairo city experienced deterioration in occupancy rates by 44.6% year-to-Date (YTD) to reach 30% by September 2020. The Average room rate and rooms yield recorded notable declines of 17.7% and 67% to reach $97 and $29, respectively.

The situation was rough also in Madina – Saudi Arabia; the occupancy rate witnessed a drop of 42.5% to reach 23% by September 2020. As for the Average Room Rate and Rooms Yield, they declined from $148 and $96 by September 2019 to lows of $116 and $26, respectively, by September 2020.

Moreover, Dubai experienced a decline in occupancy rates by 35.6% to reach 38% by September 2020. The Average room rate and Rooms yield measured a drop of 12.6% and 55%. Average room rate declined from $213 to $186 and Rooms yield measured a drastic fall from $156 to $70. The outlook points towards some positivity with the reopening of tourist attractions and some international flights and marketing initiatives by the Dubai Tourism which all represent efforts towards short-medium term recovery.

Occupancy Rates in Beirut’s Hotels by September 2020

Sources: Ernst and Young, BLOMinvest