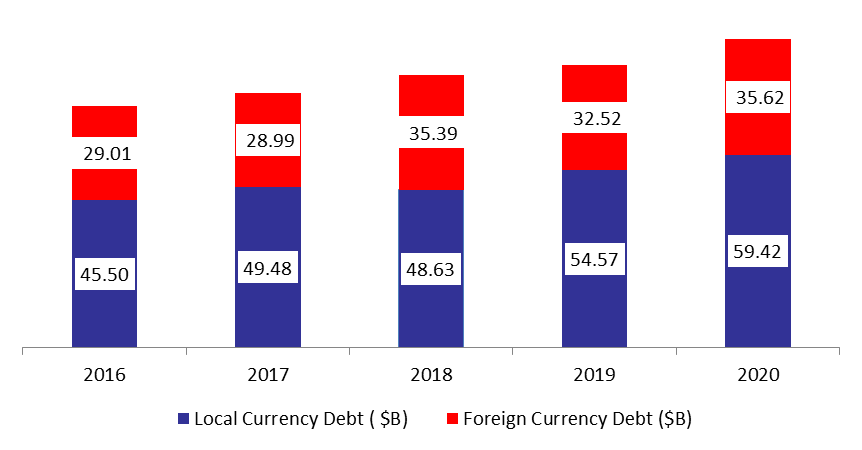

The data released by the Ministry of Finance (MoF) recently indicated that Lebanon’s gross public debt hit $95.04B in October 2020, thereby recording an annual increase of 9.1%.

The increase is mainly attributed to the 8.90% annual increase in local currency debt (denominated in LBP) which stood at $59.42B in October 2020. As such, domestic debt constituted 62.52% of the total public debt.

Meanwhile, total debt denominated in foreign currency (namely in USD) climbed by a yearly 9.53% totaling $35.62B over the same period. Therefore, total foreign debt grasped a stake of 37.48% of the total public debt by October 2020, compared to last year’s share of 37.34%. It is worth mentioning that $4.05B represents the Unpaid Eurobonds, their coupons and accrued interests.

Looking at net domestic debt, which excludes public sector deposits with the central bank and commercial banks, it increased by 7.56% annually to $49.72B in October 2020.

It is worth noting that Fitch Rating has affirmed Lebanon’s Long-Term Foreign-Currency Issuer Default Rating at Restricted Default (RD) on August 20, 2020. Moreover, Lebanon’s foreign currency government debt remains in Restricted Default following the default on Eurobonds that matured on March 9, 2020.

Lebanon needs to form a new government, apply the necessary reforms, speed up the negotiation with the IMF, and have an agreement with the international institution regarding restructuring foreign debt. However, we expect a further increase in debt in the near future in order to help end the severe recession. As such, we believe that the potential government should have a clear plan in order to make the Lebanese debt sustainable by applying fiscal reform which will increase government revenues and rationalize public expenditures.

Domestic and Foreign Debt in October ($B)

Source: Mof, BlomInvest

Source: Mof, BlomInvest