The Lebanese financial crisis had some positive effects on the real estate sector. After 17 October 2019, Lebanese Banks were not able to meet clients’ withdrawals demands in foreign currency. While an informal capital control was imposed by banks, investors and depositors tried to liberate their freezing assets by buying lands and apartments from Solidere. As a result, the company sold around $450Mto $500M worth of land in the Downtown district in the past two years.

Solidere released its consolidated financial statements for the first 6 months of 2020, revealing a downtick in its bottom line from a net profit of $42.14M by H1 2019 to a net profit of $38.06M over the same period this year.

Total revenues registered $245.09M for the first six months of 2020, compared to $182.19M by H1 2019. The total cost of revenue expanded, ending the period at $157.01M compared to $80.84M. As such, Solidere’s net operating margin weakened from 55.69% by June 2019 to a lower 37.72% margin by H1 2020. Solidere still has a portfolio of land available for sale in the new waterfront totaling 1.35 million square meters of buildable area.

Revenues from land sales reached $228.74M by June 2020, compared to $151.05M over the same period in 2019. Solidere’s Investor Relations (IR) affirmed that all buyers were a mix of Lebanese and foreigners. Meanwhile, Revenues from rented properties decreased from $27.21M in H1 2019 to $12.53M in H1 2020 as the company is still unable to collect rent from shops and restaurants due to the economic crisis in Lebanon.

As to the balance sheet, Total assets registered a loss for the first six month of 2020 by 1.85% to stand at $2.21B in H1 2020. This is mainly justified by the drops in Accounts receivables and in Inventory of land and projects from $129.94M and $1.11B in 2019 to $65.54 and $978.90M in the second quarter of 2020, respectively. In details, the decrease in “Inventory of land and projects assets” is due to the noticeable rise in the price of building materials, especially with the scarcity of dollars needed to import them.

Moreover, the increase of sales has helped Solidere to reduce their debts as the term bank loans account in the liabilities side has dropped from $155.48M in 2019 to $11.49M in the second quarter of 2020. As a result, total liabilities decreased by 19.06% in the second quarter of 2020 to stand at 337.88$ compared to 417.44$ in 2019.

Worth mentioning that Solidere issued a Press Release on June 18th 2020 in which it estimates that its non-audited expected sales will total $341.9M in 2020, based on the sales deals concluded and expected throughout the year. The announcement also mentions that the company’s reserve cash at banks grew substantially during 2020 which strengthens the company’s liquidity position and its ability to face challenges, as it increased from $20.44M at the end of 2019 to $186.97M at end June 2020.

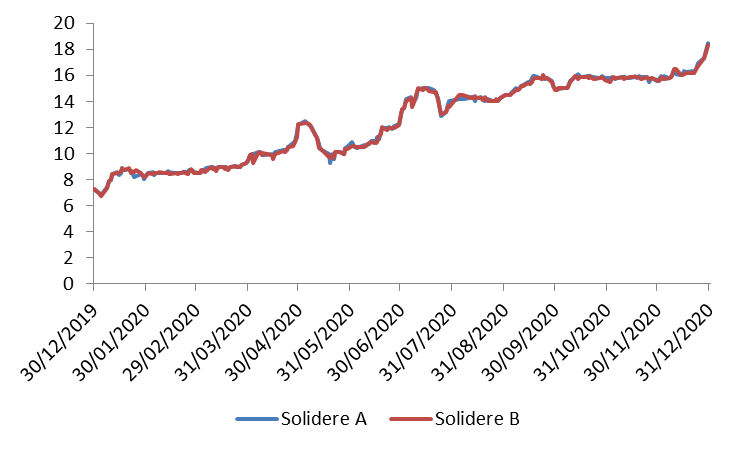

The growth in the real estate sector was positively reflected on the shares of Solidere. In details Solidere A and B shares started 2020 at $7.3 and $7.29 to reach $18.50 and $18.29 on December 30, 2020.

Solidere Stock Price Performance